Bill Ackman’s Pershing Square (PSHZF) is proposing to merge with real estate developer Howard Hughes Holdings (HHH) by forming a new subsidiary that will offer shareholders $85 per share. Ackman, a billionaire investor whose firm owns 38% of Howard Hughes, expressed dissatisfaction with the stock’s performance despite the company’s significant progress since going public 14 years ago.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Howard Hughes shares surged over 8% on the news at the time of writing. Pershing Square first invested in the real estate developer at $47.62 per share during a 2010 rights offering, resulting in a 35% total return over 14 years, translating to a modest 2.2% annualized return. Ackman highlighted that the company has paid no dividends and noted that he continues to respect CEO David O’Reilly and the company’s leadership team.

Ackman assured that under the proposed merger, Howard Hughes’ leadership, employees, and long-term strategy would remain intact. Shareholders could choose to receive a majority of their payment in cash at $85 per share, with the rest in stock from the post-merger entity. Pershing emphasized that no organizational changes or layoffs would occur as a result of the deal.

Is HHH a Good Investment?

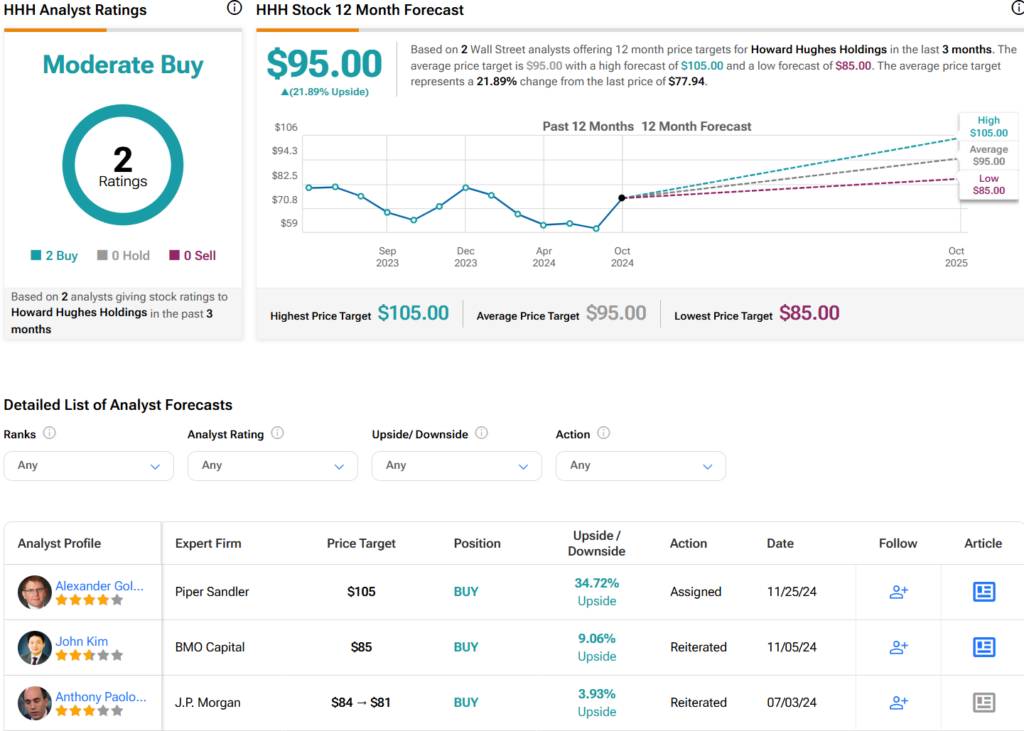

Turning to Wall Street, analysts have a Moderate Buy consensus rating on HHH stock based on two Buys assigned in the past three months, assuming the firm continues to trade publicly. After a 1% increase in its share price over the past year, the average HHH price target of $95 per share implies 21.9% upside potential.