Baxter International (BAX) has agreed to sell its Kidney Care unit to private equity investment company, Carlyle Group (CG) for $3.8 billion. The company will receive roughly $3.5 billion in cash and the net post-tax figure would be about $3 billion. The unit’s sale is part of Baxter’s company-wide transformational measures. Following the sale, the Kidney Care unit will be named Vantive.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

The net proceeds from the sale will be used to repay Baxter’s outstanding debt. The deal is expected to be completed in late 2024 or early 2025, subject to regulatory approvals and closing conditions. BAX shares dropped 6.6%, while CG shares gained 2.4% on the news.

Baxter is a global MedTech company, offering an array of healthcare products. Some of its focus areas include diagnostic, critical care, kidney care, nutrition, hospitals, and surgical products.

More on Baxter’s Strategic Sale

Baxter’s Kidney Care unit offers products for peritoneal dialysis, hemodialysis, and organ support therapies, including continuous renal replacement therapy (CRRT). In Fiscal 2023, the unit reported revenues of $4.5 billion. In the six months ending June 30, 2024, the Kidney Care unit generated revenues of $2.22 billion, representing 30% of the company’s consolidated net sales.

Baxter has been considering selling the unit since March 2024. After thoughtful consideration, the board decided that the unit’s sale would maximize shareholder value and enhance the company’s growth objectives.

Carlyle is known for making investments in medical technology and diagnostic businesses. It is acquiring Vantive in partnership with Atmas Health. Interestingly, Atmas is a healthcare partnership firm founded by Carlyle in 2022. Post-sale, Kieran Gallahue of Atmas Health will be the chairman of Vantive, while Chris Toth, group president of Baxter’s Kidney Care unit, will become the CEO.

Post-Sale Financial Targets for Baxter

Baxter provided a glimpse of its financial position, taking into account the Vantive sale. Baxter seeks to reach annual operational sales growth of 4% to 5%, aided by continued product innovation and market share gains. Plus, the adjusted operating margin for Fiscal 2025 is projected at 16.5%.

Moreover, Baxter aims to reduce its debt load and expects to reach investment-grade target of below 3x by the end of 2025. As of June 30, Baxter’s long-term debt stood at $10.44 billion.

On August 6, Baxter reported its Q2 FY24 results, in which earnings per share of $0.68 beat the consensus of $0.66. Also, net sales rose 2.7% year-over-year to $3.81 billion, exceeding the Street’s estimates of $3.75 billion.

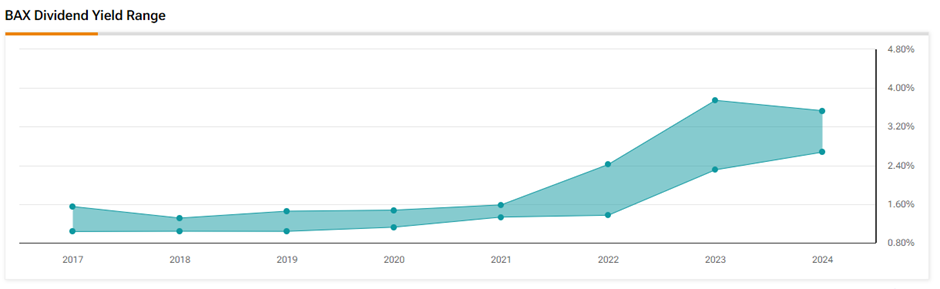

Baxter Boasts Solid Dividend Yield

Baxter pays above-industry average dividends, with a current yield of 3.12%. The company announced a quarterly cash dividend of $0.29 per share, payable on October 1, 2024, to shareholders of record on August 30, 2024.

Is Baxter a Good Stock to Buy?

On TipRanks, BAX stock has a Hold consensus rating based on two Buys, seven Holds, and one Sell rating. The average Baxter International price target of $41.10 implies 19.1% upside potential from current levels. Shares have declined 9.3% year-to-date.