Shares in drug developer Amgen (AMGN) looked brighter today after it bought Dark Blue Therapeutics, a British cancer-fighting biotech for $840 million.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Blood Cancer Target

Amgen said that the deal would bring to its existing portfolio of drugs an investigational small molecule that targets and degrades two proteins (MLLT1/3) that drive specific types of acute myeloid leukemia (AML), a fast-growing blood cancer. Amgen said that preclinical data in leukemia models demonstrate “promising anti-cancer activity and mechanistic differentiation from currently available therapies.”

AML is a rare form of cancer with around 20,000 new cases diagnosed each year in the U.S. and about 3,000 in the U.K. There are about 10,000 deaths per year in the U.S., or 20% of all blood cancers.

“Acute myeloid leukemia remains one of the most difficult cancers to treat, and we see an urgent need for new mechanisms capable of changing the trajectory of this disease,” said Jay Bradner, M.D., executive vice president of Research and Development at Amgen. “This acquisition complements and extends our research in targeted protein degradation and leukemia therapeutics, advancing our strategy to invest early in rising medicines for novel therapeutic targets. The adjacency of this program to our considered expertise in cancer biology will propel MLLT1/3-targeting medicines to clinical investigation for patients facing the challenging diagnosis of AML.”

Boost to Pipeline

The deal will add to Amgen’s existing pipeline of cancer drugs and will ideally bring another boost to its share price. It is up nearly 25% over the last 12 months – see below:

Amgen expects to integrate Oxford-based Dark Blue Therapeutics into its existing research organization, further strengthening the company’s early oncology discovery efforts.

Is AMGN a Good Stock to Buy Now?

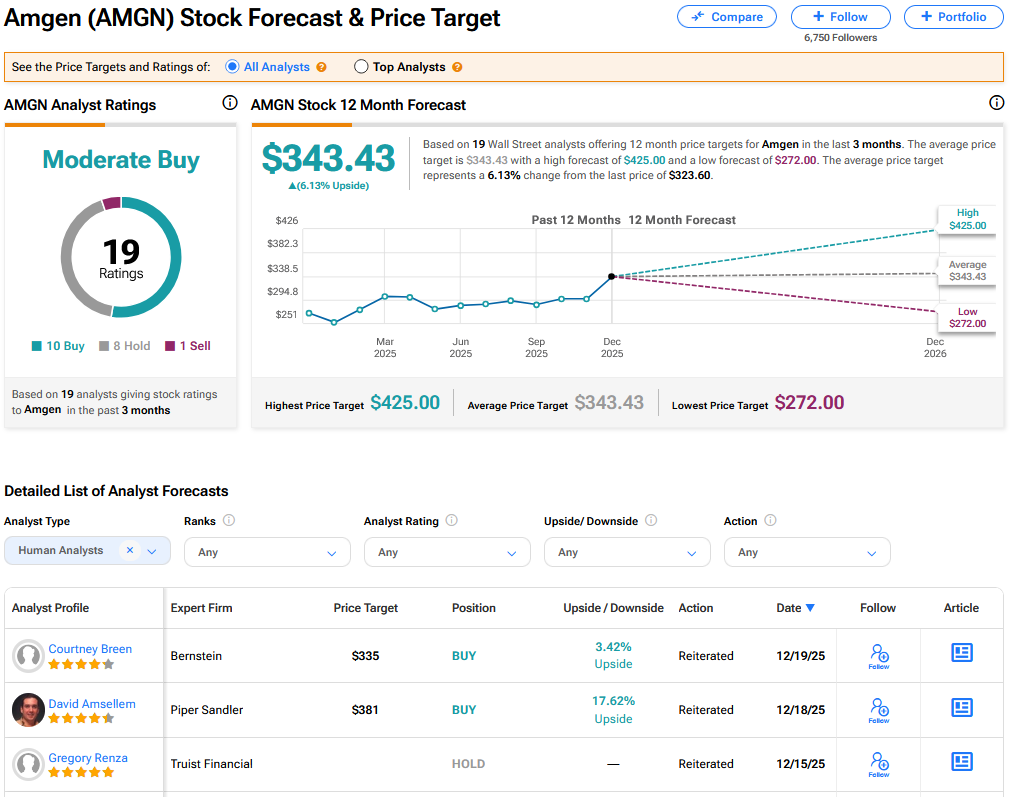

On TipRanks, AMGN has a Moderate Buy consensus based on 10 Buy, 8 Hold and 1 Sell ratings. Its highest price target is $425. AMGN stock’s consensus price target is $343.43, implying a 6.13% upside.