Shares of Advance Auto Parts (AAP), a provider of automotive aftermarket parts and accessories in North America, plummeted after the company announced both the sale of its automotive parts wholesale distribution business and a downward revision of its FY24 forecast. Specifically, AAP revealed that it would be selling Worldpac to the global investment firm Carlyle (CG) for $1.5 billion in cash. The transaction is expected to close by the end of the year.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Why Is AAP Selling Worldpac?

The decision to sell Worldpac comes in response to pressure from activist investors, who have been urging the company to divest this business as part of its broader turnaround strategy. AAP anticipates net proceeds of around $1.2 billion after accounting for taxes and transaction fees. Notably, Worldpac generated $2.1 billion in revenue and approximately $100 million in EBITDA in the twelve months leading up to the end of the second quarter of FY24.

AAP Posts Flat Q2 Revenue

Alongside the sale announcement, AAP reported its second-quarter results, which showed flat year-over-year revenues at $2.7 billion, matching analysts’ expectations. The company’s comparable store sales saw a modest increase of 0.4%.

However, the company’s diluted earnings for Q2 came in at $0.75 per share, a significant drop from $1.32 in the same period last year and below the consensus estimate of $0.93 per share.

AAP Slashes FY24 Guidance

Adding to the concerns, AAP lowered its annual sales and profit forecasts, attributing the revision to weak demand for auto parts. The company now expects FY24 net sales to range between $11.15 billion and $11.25 billion, down from the previous forecast of $11.3 billion to $11.4 billion.

Additionally, AAP has revised its projected diluted earnings to fall between $2 and $2.50 per share, a sharp decrease from the prior forecast of $3.75 to $4.25 per share. Analysts had been expecting earnings of $3.52 per share on revenues of $11.3 billion.

Is AAP Stock a Buy?

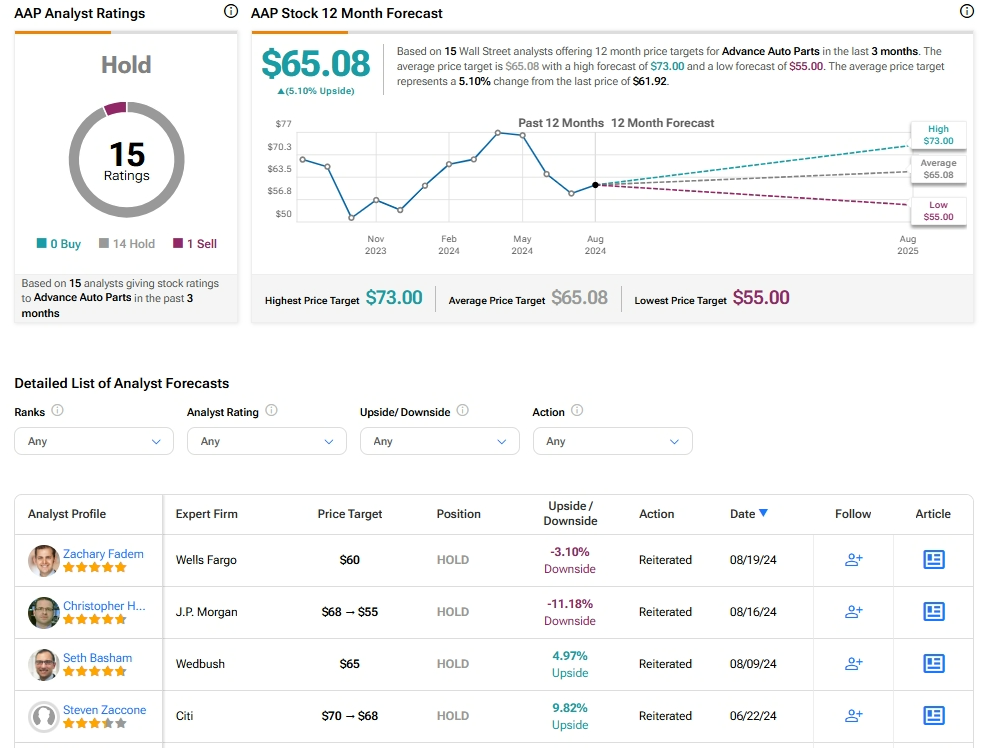

Analysts remain sidelined about AAP stock, with a Hold consensus rating based on 14 Holds and one Sell. Over the past year, AAP has declined by more than 5%, and the average AAP price target of $65.08 implies an upside potential of 5.1% from current levels.