Mastercard (MA) reported strong results for the second quarter. The company announced adjusted earnings of $3.59 per diluted share, up 24% year-over-year, which exceeded analysts’ expectations of $3.51 per share.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The payments processing company posted net revenues of $7 billion, an 11% increase year-over-year, beating consensus estimates of $6.85 billion. Additionally, Mastercard’s gross dollar volume for the second quarter was up 9%, while purchase volume increased by 10% on a local currency basis. Gross dollar volume measures the total volume of card activity in dollar terms, both domestic and cross-border, on a local currency and U.S. dollar-converted basis.

Moreover, switched volume, which measures the value of transactions on Mastercard’s network, increased by 10% in Q2, compared to 12% in Q1.

MA CEO’s Comments

Michael Miebach, Mastercard CEO, commented that the company’s robust results were “supported by continued healthy consumer spending, robust cross-border volume growth of 17%, and demand for our value-added services and solutions where net revenue increased 18%, or 19% on a currency-neutral basis.”

Cross-border volume measures international card spending processed on MA’s network. This metric went up by 17% on a local currency basis in Q2.

Is MA a Good Stock to Buy Now?

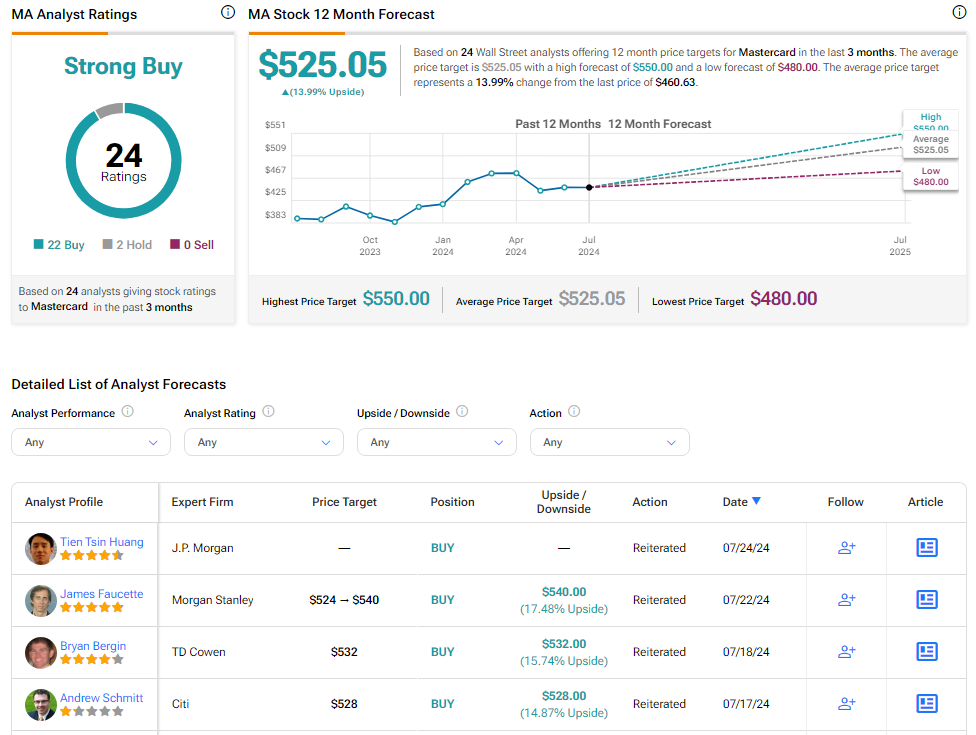

Analysts remain bullish about MA stock, with a Strong Buy consensus rating based on 22 Buys and two Holds. Over the past year, MA has increased by more than 15%, and the average MA price target of $525.05 implies an upside potential of 14% from current levels. These analyst ratings are likely to change following MA’s results today.