AbbVie (NYSE:ABBV) seems to double down on acquisitions to gain a better position in the healthcare sector. It recently announced its second major acquisition within a week, agreeing to purchase Cerevel Therapeutics (NASDAQ:CERE) in an all-cash deal valued at $8.7 billion. AbbVie believes that CERE’s promising pipeline for multiple diseases holds significant potential to strengthen its neuroscience portfolio.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Cerevel is a biopharmaceutical company focused on developing new therapies to treat disorders of the central nervous system. Currently, the company is developing potential candidates to treat schizophrenia, Parkinson’s disease, and mood disorders.

Terms of the Deal

As per the terms of the agreement, AbbVie will pay $45 in cash for each Cerevel share. The deal is expected to close in mid-2024, provided that the shareholders of Cerevel approve the deal and necessary regulatory approvals are obtained.

Regarding financial benefits, ABBV expects it to be accretive to adjusted earnings per share beginning in 2030.

It is worth highlighting that on November 30, AbbVie revealed plans to acquire ImmunoGen (NASDAQ:IMGN) for $10.1 billion. The company anticipates that IMGN’s impressive oncology portfolio will support significant long-term revenue growth.

Is ABBV Stock a Buy or Sell?

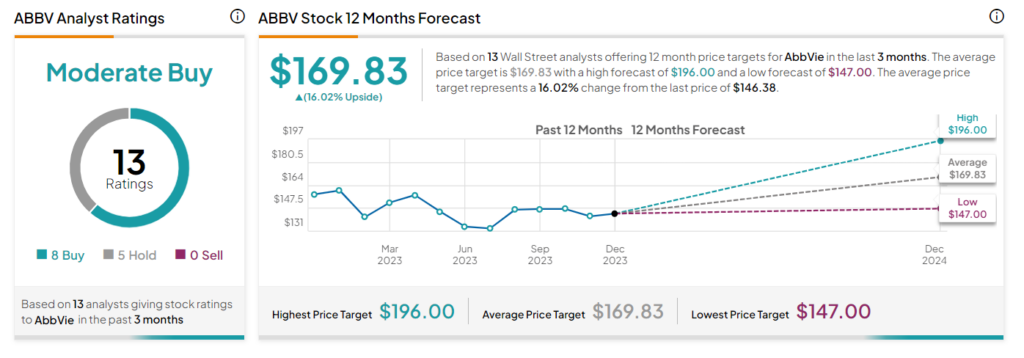

Overall, Wall Street analysts have a Moderate Buy consensus rating on ABBV stock based on eight Buys and five Holds assigned in the past three months. Furthermore, the average AbbVie price target of $169.83 per share implies 16% upside potential. Shares of the company are down 6.2% so far this year.