LyondellBasell is a chemical company that trades at just 8.5x its 10-year average free cash flow. LyondellBasell stock (NYSE:LYB) appears to be cheap for three reasons: the market expects the current commodity chemicals downturn to continue, many ESG-friendly funds cannot own a stock like LYB, and LyondellBasell does not sell exciting, new-age products. I don’t believe these are compelling reasons for a long-term investor to sell LYB. Let me explain why I’m bullish on the stock.

Claim 50% Off TipRanks Premium and Invest with Confidence

- Unlock hedge-fund level data and powerful investing tools designed to help you make smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis so your portfolio is always positioned for maximum potential

First off, one of LYB’s main markets, Europe, has already experienced a softening economy. Downturns like this are typically a good time to buy fundamentally strong cyclical stocks. Next, the company is beginning to produce innovative, recycled products. LYB should improve its environmental impact by leaps and bounds in the years ahead. Lastly, LyondellBasell is poised to benefit from the increasing use of its materials in growth categories like electric cars, food packaging, and solar panels.

The Current Chemicals Downturn

Currently, commodity chemical companies are facing challenges in China and losing money in Europe. As a result, LyondellBasell’s cash flow from operating activities has fallen by 44% since 2021. This sort of thing can occur when input costs are high and demand is weak.

However, LyondellBasell has advantaged input costs or “feedstocks” in North America and is also securing an advantaged position in the Middle East. This cost advantage allows LyondellBasell to remain highly profitable, even during challenging times. The company produced $3.4 billion of free cash flow last year. This compares to $2.5 billion for Dow Inc. (NYSE:DOW) and $3.3 billion for BASF SE (OTC:BASFY), chemical companies with substantially larger market caps.

LyondellBasell also has the financial fortitude to weather this downturn. The company has been building up its cash position recently and now has a current ratio of 1.85x. The company’s debt also looks manageable, with $7.83 billion of net debt compared to adjusted EBITDA of $5.2 billion.

A Compelling Growth Runway

Despite LYB’s cheap valuation, the company appears poised to grow. At last year’s capital markets day, LyondellBasell set lofty growth expectations, as you can see below.

While $23 of 2027 diluted EPS looks ambitious to me, LyondellBasell has some compelling growth drivers. First, LyondellBasell’s core plastics end markets are expected to grow at a decent clip. This should be driven primarily by emerging markets increasing their use of plastics in food packaging and industrial production.

Source: LyondellBasell’s 2023 Capital Markets Day

Next, the company is developing a circular and low-carbon solutions business that is expected to generate $1 billion of EBITDA by 2030. This business stems from a simple premise; that is, many consumers are willing to pay more for recycled plastics. Also, the company expects the demand for these recycled goods to significantly outpace supply. This should allow LyondellBasell to make a decent profit.

Finally, we can expect LyondellBasell to spend a large portion of its cash on cost-advantaged capacity expansion and share buybacks. Over the past decade, the company has decreased its share count by 37%. At the same time, LYB maintains a rigorous focus on cutting expenses. All of this should increase the company’s EPS over time.

Is LYB Stock a Buy, According to Analysts?

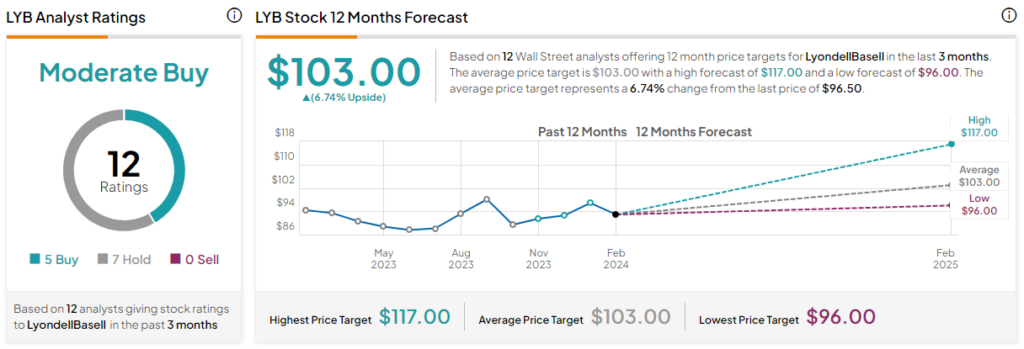

With some recent upgrades, and possibly more to come, five out of 12 analysts covering LYB now give it a Buy rating, and seven rate it a Hold, giving it a Moderate Buy consensus rating. The average LYB stock price target is $103, implying upside potential of 6.7%. Analyst price targets range from a low of $96 per share to a high of $117 per share.

The main problem I have with analyst price targets is that they have a short focus, looking only one year out. Many analysts expect continued weakness in 2024, and LYB is already running many of its plants at a fraction of full capacity. However, if one looks through to 2027, 2030, or heck, even 2033, LYB looks like it presents compelling value based on its strong balance sheet, resilient free cash flow generation, and long-term growth drivers.

The Bottom Line on LYB Stock

LyondellBassell is a fundamentally strong company and cash flow machine. Its stock, however, is unloved due to cyclical headwinds in China and Europe and its lack of ESG-friendly, futuristic appeal. Despite this, I think LyondellBasell has a compelling growth story that the market just hasn’t picked up on yet. The business should significantly reduce its emissions over time and become a profitable producer of recycled plastics. Lastly, with LYB’s strong balance sheet and cost-advantaged feedstocks, it should emerge from this downturn stronger.