Shares in Lyft Technologies (LYFT) stalled today despite a leading analyst predicting that customer numbers in California were set to accelerate thanks to price cuts.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Insurance Hopes

John Blackledge of TD Cowen upped his price target on Lyft stock to $30 from $22 and kept a Buy rating. The Five-Star TipRanks-rated Blackledge pointed to potential changes in California insurance law, which could see uninsured and underinsured motorist coverage in the state reduce from $1 million to $60,000 per person and $300,000 per incident.

According to Lyft’s ride-hailing rival Uber (UBER) nearly a third of a rider’s fare currently goes to pay for state-mandated insurance costs in California compared to less than 5% of rider fares in other states such as Massachusetts.

Blackledge estimates that the change could result in hundreds of millions in annualized savings for Lyft, which he expects it to return to riders via lower trip prices. That in turn, he said, should drive rider growth in the state in 2026.

Strong Narrative

He added that overall, the Lyft “narrative is on the upswing with the recently announced partnership between Lyft and Alphabet (GOOGL)-owned Waymo in Nashville.

As part of that partnership, Lyft’s subsidiary Flexdrive will provide end-to-end fleet management for Waymo, meaning that it will oversee vehicle maintenance, infrastructure setup, depot operations, and other related tasks.

According to both companies, interested riders at the start can only book the driverless service on Waymo’s app. However, plans are also underway to launch on Lyft’s network in 2026.

Blackledge also raised his forecast for Gross Bookings and EBITDA at Lyft in 2026 by 1% and around 5% respectively.

Earlier this week Daniel Kurnos, analyst at Benchmark raised his price target to $26 from $20. He said Lyft had “furthered their credibility in the rideshare space” with the Waymo deal breaking Uber’s “perceived stranglehold”.

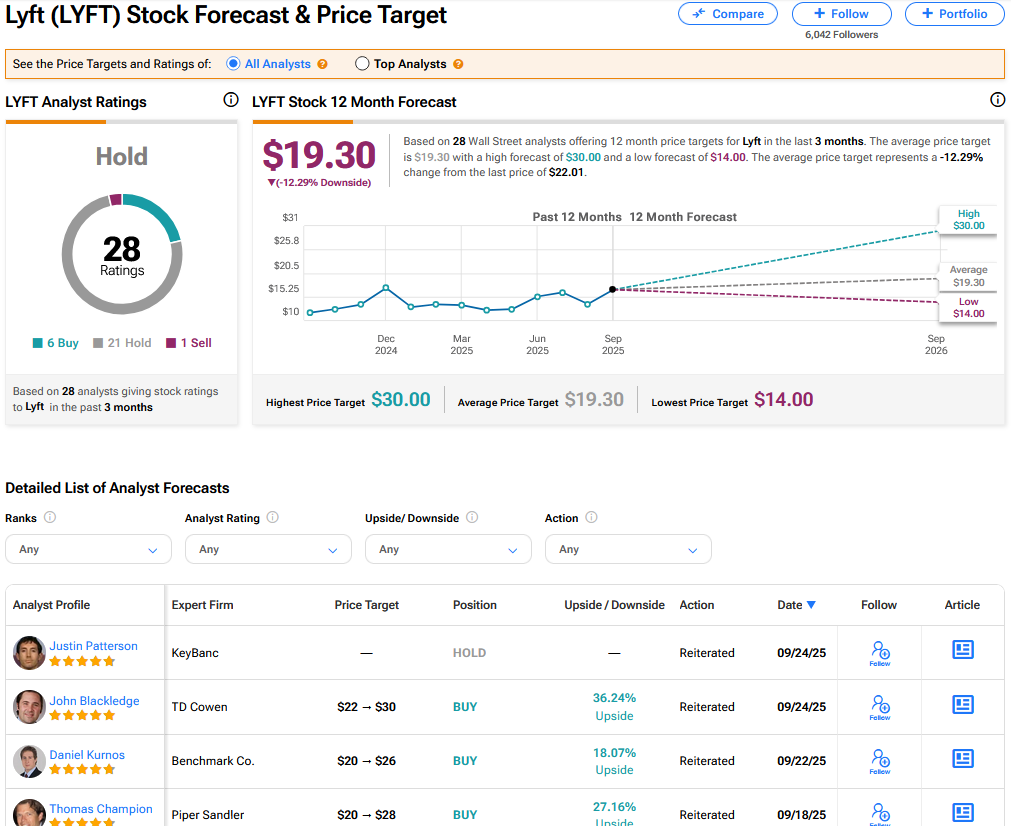

Such sentiment has helped the Lyft share price surge 15% in the last five days, and by 70% in the year-to-date – see above.

Is LYFT a Good Stock to Buy Now?

On TipRanks, LYFT has a Hold consensus based on 6 Buy, 21 Hold and 1 Sell rating. Its highest price target is $30. LYFT stock’s consensus price target is $19.30, implying a 12.29% downside.