For years, ride-hailing company Lyft (LYFT) lived in competitor Uber’s (UBER) shadow, but that has started to change. By focusing on markets where Uber is less dominant, Lyft has delivered strong operating results in its core ride-sharing business. As a result, the company has now posted its tenth straight quarter of double-digit ride growth, driven in part by a 50% increase in higher-margin premium rides. At the same time, revenue rose by 11% and active riders increased by 18%.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

In addition, autonomy is becoming a critical part of Lyft’s long-term strategy, thanks to partnerships with Baidu (BIDU), May Mobility, and Waymo (GOOGL), which give it exposure to autonomous technology without taking on development costs. Moreover, Lyft is building a facility that is dedicated to servicing and charging Waymo vehicles. Lyft is also pursuing new opportunities through its “Lyft Ready” program, which would allow personally owned autonomous vehicles to operate on its platform using Lyft’s fleet management services.

This could turn AVs into income-producing assets for both owners and Lyft itself, as highlighted by comments from Lyft executive Jeremy Bird. Still, challenges remain as analysts warn that first-party AV operators like Waymo and Tesla (TSLA) may eventually reduce their reliance on third-party platforms. Even so, Lyft is expected to generate more than $1 billion in free cash flow, and its shares are up 52% this year, outperforming Uber and the S&P 500.

Is LYFT Stock a Good Buy?

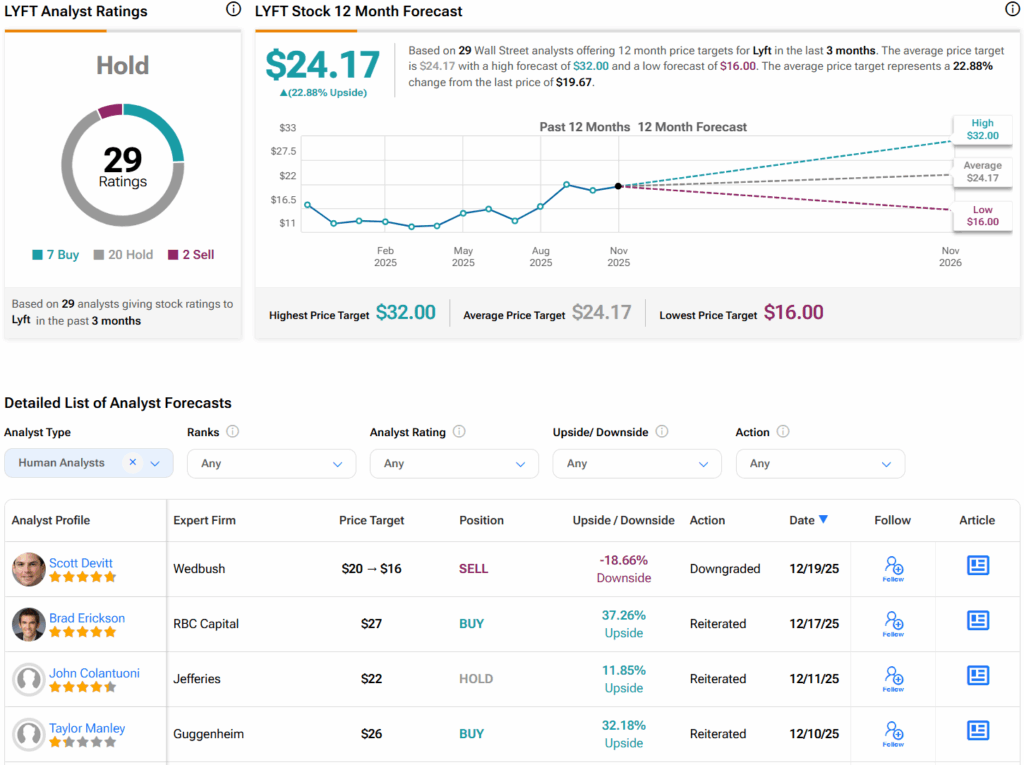

Turning to Wall Street, analysts have a Hold consensus rating on LYFT stock based on seven Buys, 20 Holds, and two Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average LYFT price target of $24.17 per share implies 22.9% upside potential.