TipRanks allows investors to keep track of the investment activities of financial experts, such as hedge fund managers. By compiling the data from Form 13-Fs released by 487 hedge funds, the TipRanks Hedge Fund Confidence Signal indicates how bullish these managers are about a stock. Today, using the TipRanks Stock Screener tool, we have focused on two such stocks: Las Vegas Sands (NYSE:LVS) and PG&E Corp. (NYSE:PCG). Both stocks carry a “Strong Buy” rating and were bought by hedge funds in the last quarter.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

Let’s delve deeper into these two stocks.

Las Vegas Sands

LVS is an American casino and resort company. The recovery in Chinese and Asian travel demand is expected to continue to aid the company’s top-line growth.

Moreover, LVS is renovating Singapore’s Marina Bay Sands (MBS) resort, which is likely to be completed by the Chinese New Year (early 2025). The revamped MBS and the easing visa policy between China and Singapore could be tailwinds going forward.

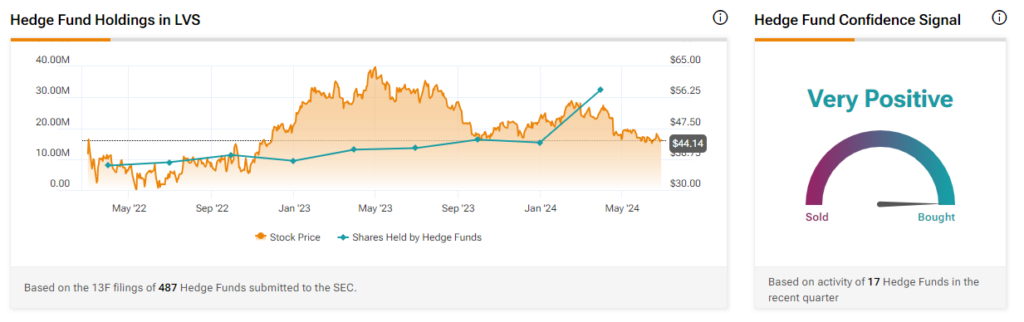

As per TipRanks’ database, hedge funds bought 17.2 million shares of Las Vegas Sands last quarter. Several hedge fund managers increased their holdings in the stock, including Fisher Asset Management’s Ken Fisher and Joel Greenblatt of Gotham Asset Management, among others. Also, the Hedge Fund Confidence Signal is currently Very Positive.

Is LVS a Good Stock to Buy?

Wall Street is bullish about LVS. It has received 11 Buy and one Hold recommendations, translating into a Strong Buy consensus rating. The analysts’ average price target on LVS stock of $61.55 suggests an upside potential of 39.4%. Shares of the company have declined 22.3% in the past year.

Pacific Gas & Electric Corp.

PG&E generates and distributes electricity and natural gas in northern and central California. The company’s cost-cutting strategy could save around $100 million annually.

Further, PCG’s efforts to drive electric vehicle (EV) adoption and expand its data center’s capacity could be beneficial for PG&E in the long term.

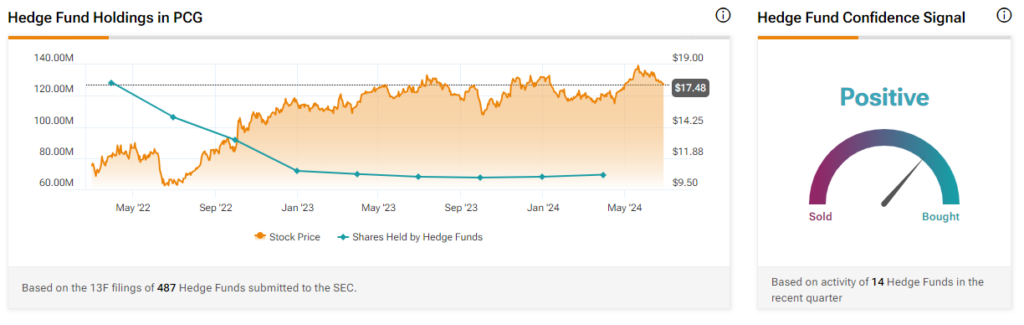

Interestingly, the stock has a “Positive” signal from TipRanks’ Hedge Fund Trading Activity tool. The tool shows that hedge funds bought 1.3 million shares of this company in the last quarter. Our data shows that Joel Greenblatt and Graham Capital Management’s Kenneth Tropin were among the hedge fund managers who increased their exposure to PCG stock.

Is PCG a Good Stock to Buy?

It has received nine Buy and one Hold recommendations for a Strong Buy consensus rating. The analysts’ average price target on PCG stock of $20.94 implies 19.79% upside potential from current levels. Shares of the company have gained 3.5% over the past year.

Concluding Thoughts

The impressive track record of hedge fund managers may encourage investors to adopt their portfolio allocation strategy. For more ideas on Top Expert Picks, investors can visit the TipRanks Expert Center and make informed investment decisions.