Shares of Southwest Airlines (LUV) dropped in pre-market trading after the company’s earnings plunged in the second quarter. The airline’s Q2 earnings of $0.58 per share plunged by 46% year-over-year, which beat analysts’ consensus estimate of $0.52 per share.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The airline company generated operating revenues of $7.4 billion, an increase of 4.5% year-over-year, which exceeded analysts’ expectations of $7.3 billion.

Southwest Faces Delays in Aircraft Deliveries

Southwest is increasingly facing delays in aircraft delivery from Boeing (BA) and continues to plan for around 20 deliveries of Boeing 737-8 aircraft in 2024 instead of its prior forecast of 40 deliveries. LUV has also projected a fleet of around 802 aircraft by the end of this year. Furthermore, the company announced that it is negotiating compensation from Boeing for delayed aircraft deliveries.

Southwest Is Overhauling Its Business Model

Increasingly, LUV is facing pressure from investors, particularly with Elliott Investment Management acquiring a $2 billion stake. As a result, Southwest is overhauling its business model. These changes include eliminating open seating, offering seats with extra legroom, and adding overnight flights.

LUV expects to offer these measures starting next year and aims to boost revenues. Southwest’s CEO Bob Jordan commented, “We are taking urgent and deliberate steps to mitigate near-term revenue challenges and implement longer-term transformational initiatives that are designed to drive meaningful top and bottom-line growth.”

LUV’s Q3 and FY24 Outlook

Looking forward, management now expects Revenue per Available Seat Mile (RASM) in the third quarter to be flat or down by 2% year-over-year. The company has projected available seat miles (airline seating capacity) to increase by around 2% year-over-year in the third quarter.

In FY24, Southwest has projected its Available Seat Miles (ASM) to be up by around 4% with operating expenses per available seat mile, excluding fuel and oil expenses, to increase in the range of 7% to 8%.

Is LUV a Good Buy Now?

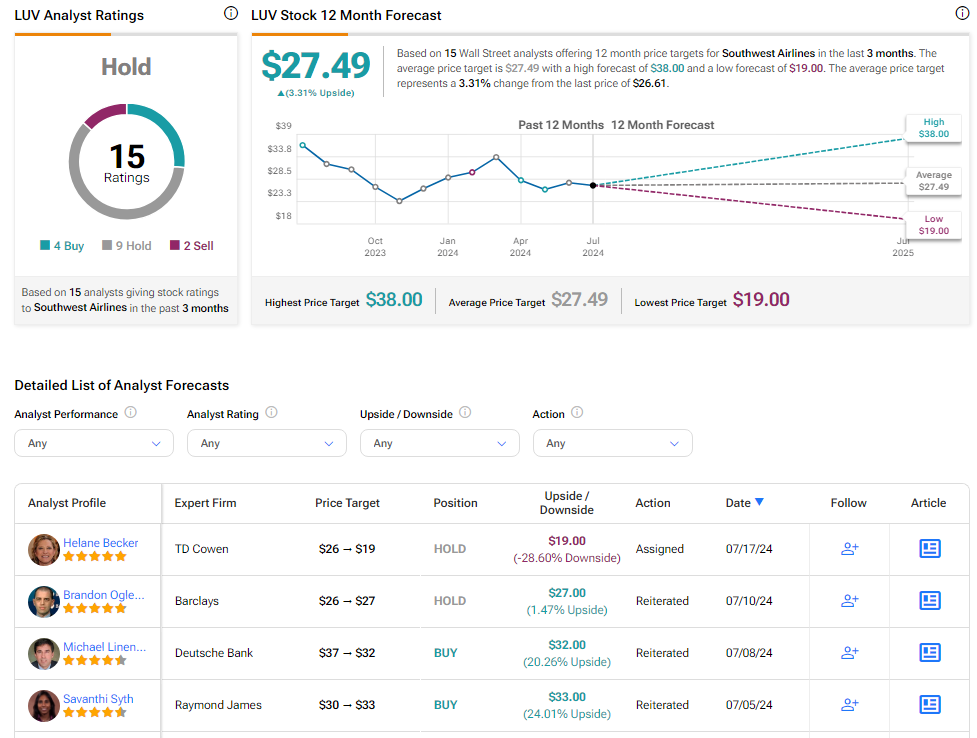

Analysts remain sidelined about LUV stock, with a Hold consensus rating based on four Buys, nine Holds, and two Sells. Over the past year, LUV has declined by more than 20%, and the average LUV price target of $27.49 implies an upside potential of 3.3% from current levels. These analyst ratings are likely to change following LUV’s results today.