Southwest Airlines (LUV) stock is down today despite the air travel company beating Q4 2024 profit estimates. The company’s earnings per share were 56 cents, well above Wall Street’s estimate of 46 cents. This also represents a 51.35% increase year-over-year compared to 37 cents.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Unfortunately, revenue of $6.93 billion failed to reach analysts’ estimate of $6.96 billion as it only increased 1.6% from $6.82 billion in Q4 2023. Southwest Airlines Vice Chairman, President, and CEO Bob Jordan said the company is “pleased that the improvements from our tactical initiatives are materializing faster than expected” but noted it still has “much work to do.”

Southwest Airlines investors agree as the mixed earnings report drags the company’s shares down 1.55% during pre-market trading. LUV stock is also down 5.86% year-to-date but is still up 8.35% over the past 52 weeks.

LUV Stock 2025 Guidance

Southwest Airlines also includes a series of guidance updates in its most recent earnings report. The company expects Q1 RASM to increase 5% to 7% year-over-year, ASMs to drop 2% to 3% year-over-year, fuel costs per gallon ranging from $2.50 to $2.60, and CASMs to rise 7% to 9% year-over-year.

Jordan notes the company is confident about its performance in 2025 and has launched a “$750 million accelerated share repurchase, with the initial $250 million share repurchase now complete.”

Is LUV Stock a Buy, Sell, or Hold?

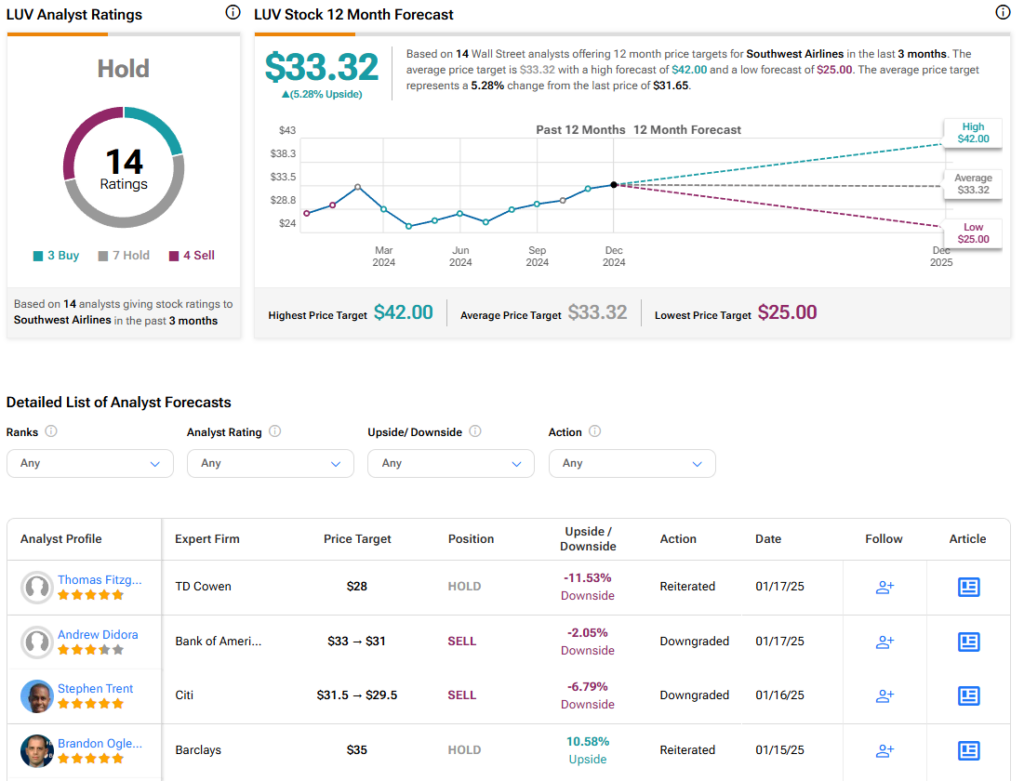

Turning to Wall Street, the analysts’ consensus rating for Southwest Airlines is Hold based on three Buy, seven Hold, and four Sell ratings over the last three months. With that comes an average price target of $33.32, a high of $42, and a low of $25. This represents a potential 5.28% upside for LUV stock. These ratings and price targets will likely change as analyst update their coverage after the earnings report.