A selloff in Lumen Technologies (LUMN) yesterday on reports it’s about to sell its consumer fiber business was overdone, according to at least one analyst who believes the market got it wrong.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Wells Fargo says the selloff in shares of Lumen after Bloomberg reported AT&T (T) is in advanced talks to acquire the company’s Quantum Fiber business for at least $5.5 billion “seems overdone.” Shares of LUMN fell more than 9% on Tuesday, while AT&T shares rallied over 1%.

The reported deal would be both accretive to Lumen’s free cash flow and deleveraging, analyst Eric Luebchow told investors in a research note. For AT&T, it’s a more mixed story as the deal would be cash flow dilutive but would expand the company’s addressable market for fiber to greater than 55 million subscribers. Wells Fargo kept an Equal Weight rating on Lumen with a $5 price target.

LUMN Looks to Exit Residential Fiber Business

Lumen’s residential and enterprise fiber business was run under the CenturyLink brand name until 2020. The reported deal between Lumen and AT&T would apply to the consumer fiber broadband operations, Bloomberg said

It follows a December 2024 report by Reuters, which said that Lumen had commenced a process to sell its consumer fiber business. Subsequently chief financial officer Chris Stansbury spoke at a conference earlier this month about monetizing the company’s fiber-to-the-home business via an exit. He indicated that as the industry consolidates, Lumen had no wish to be a consolidator.

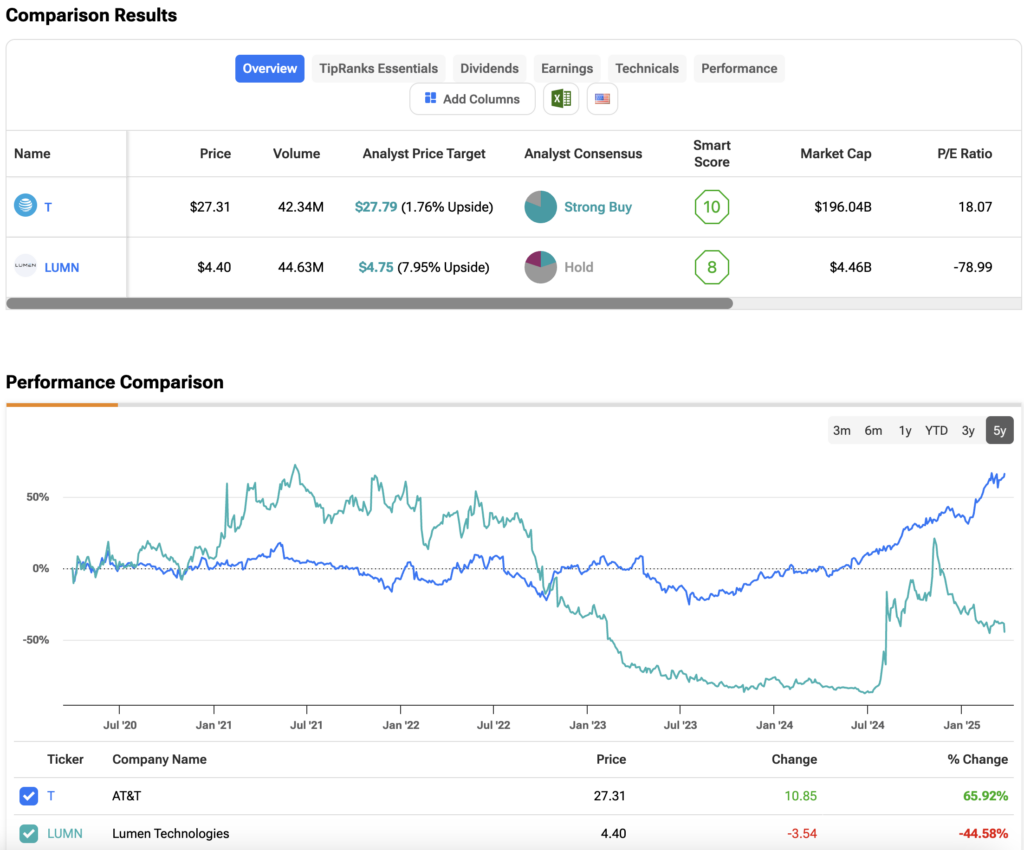

LUMN vs T

Wall Street is bullish on AT&T stock with a Strong Buy consensus rating. However, analysts are less sure on LUMN stock, with a Hold consensus rating based on one Buy, three Holds, and one Sell recommendation. The average LUMN stock price target of $4.75 implies about 8% upside potential.