Athletic apparel company Lululemon (LULU) is scheduled to announce its results for the third quarter of Fiscal 2024 after the market closes on December 5. LULU stock is down 34% year-to-date even after advancing 32% in the past three months due to improved sentiment. Analysts expect the company’s Q3 FY24 earnings per share (EPS) to rise more than 7% year-over-year to $2.71 and revenue to increase 7.3% to $2.36 billion.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Lululemon exceeded analysts’ earnings expectations for the Fiscal second quarter but lagged revenue estimates. The top-line performance was impacted by a slowdown in the domestic market amid macro pressures and increased competition as well as the lack of innovation in key areas like the women’s category.

Analysts’ Views Ahead of LULU’s Earnings Report

Heading into the Q3 print, TD Cowen analyst John Kernan reaffirmed a Buy rating on LULU stock and increased the price target slightly to $383 from $382. The analyst expects the company’s Q3 FY24 revenue to rise 6.6% year-over-year, which is lower than the consensus estimate. Kernan’s lower Q3 FY24 estimate indicates his expectations of flat revenue growth in the Americas region compared to the 1% growth in Q2 FY24.

Further, he expects LULU’s revenue from China to rise 32% and revenue from the Rest of the World to increase 28% year-over-year. Kernan highlighted that the company’s SimilarWeb and Google Search data deteriorated in October. However, alternative traffic and credit card data were stable, continuing to indicate stability in in-store business but share losses in e-commerce. He expects management to reaffirm the full-year outlook. Overall, Kernan remains bullish on Lululemon stock and believes that its valuation is still cheap compared to its peers.

Meanwhile, Citi analyst Paul Lejuez reiterated a Hold rating on LULU stock with a price target of $270. The analyst expects Q3 EPS of $2.79 on a slight comparable sales growth (comps) beat due to stronger international sales. Lejuez expects Q3 Americas comps to decline by 2% as he expects no meaningful improvement in trends compared to the second quarter. He anticipates weaker U.S. trends to continue in Fiscal 2025.

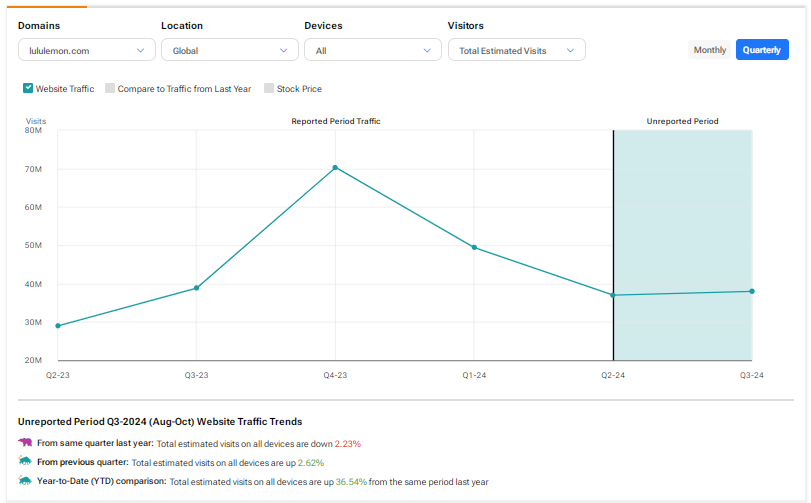

Website Traffic Hints at Challenges

As indicated by Kernan, Lululemon faced challenges in online sales in Q3 FY24. As per TipRanks’ Website Traffic Tool, the visits to lululemon.com declined 2.23% year-over-year in Q3 FY24 and increased by a modest 2.6% compared to the second quarter. Lower online sales could imply headwinds for the company’s overall top-line growth.

Options Traders Anticipate a Major Move

TipRanks’ Options tool offers a quick way to gauge what options traders anticipate from the stock following its earnings report. The expected earnings move is calculated using the at-the-money straddle of the options set to expire closest to the announcement. While this may sound complex, the tool handles the calculations for you.

Currently, it indicates that options traders are predicting about an 8.9% swing in either direction in LULU stock.

Is LULU a Good Stock to Buy?

Wall Street is cautiously optimistic on Lululemon stock, with a Moderate Buy consensus rating based on 12 Buys, six Holds, and one Sell rating. The average LULU stock price target of $330.06 implies a downside risk of 3.1% from current levels.