Securities regulators in Canada are considering allowing publicly traded companies to report their financial results on a semi-annual basis or twice a year.

Claim 50% Off TipRanks Premium and Invest with Confidence

- Unlock hedge-fund level data and powerful investing tools designed to help you make smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis so your portfolio is always positioned for maximum potential

The move would be a big change from current regulations that require public companies to report their earnings on a quarterly basis, or four times per year. The U.S. Securities and Exchange Commission (SEC) is also considering allowing companies to report their financial results semi-annually after President Donald Trump promoted the idea on social media.

North of the U.S. border, the Canadian Securities Administrators (CSA) has unveiled the “Semi-Annual Reporting (SAR) Pilot,” which would allow certain public companies to forgo first- and third-quarter financial disclosures in favor of a twice-a-year reporting schedule. During the pilot, eligible companies would include those listed on the TSX Venture Exchange and the Canadian Securities Exchange.

Reducing Regulations

Should the pilot project be successful, it could be broadened to include the entire Toronto Stock Exchange, Canada’s main bourse. Leading Canadian publicly traded companies include Lululemon Athletica (LULU), Shopify (SHOP), and Thomson Reuters (TRI).

The pilot project related to semi-annual reporting is aimed at reducing regulations and red tape, and boosting Canada’s capital markets. The move to allow companies to issue earnings statements only twice a year is wholeheartedly endorsed by President Trump.

This summer, Trump wrote on social media: “Companies and Corporations should no longer be forced to ‘Report’ on a quarterly basis (Quarterly Reporting!), but rather to Report on a ‘Six (6) Month Basis.’ This will save money, and allow managers to focus on properly running their companies.”

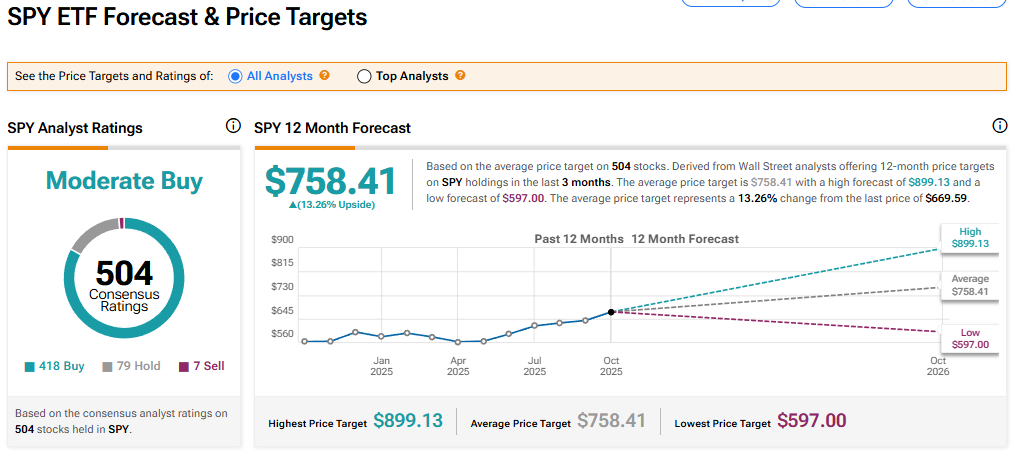

Is the SPDR S&P 500 ETF Trust a Buy?

The SPDR S&P 500 ETF Trust (SPY) currently has a Moderate Buy rating among 504 Wall Street analysts. That rating is based on 418 Buy, 79 Hold, and seven Sell recommendations issued in the last three months. The average SPY price target of $758.41 implies 13.26% upside from current levels.