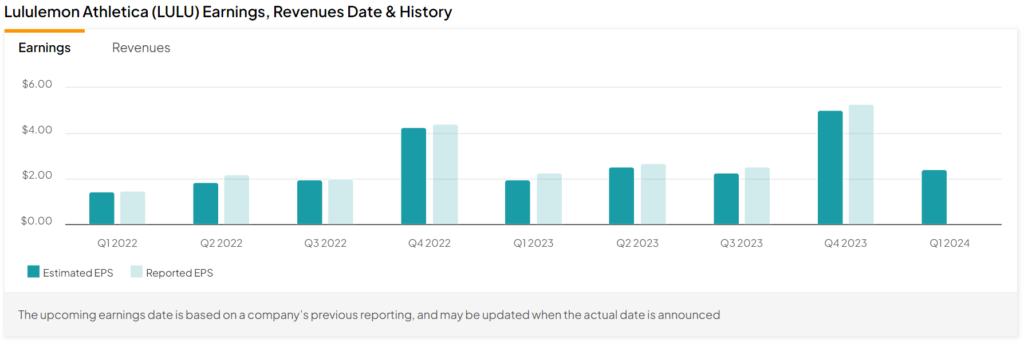

Shares of Lululemon (NASDAQ:LULU) jumped 10% in after-hours trading after the clothing retailer reported its Q1 earnings results. Adjusted earnings per share came in at $2.54, which beat analysts’ consensus estimate of $2.40 per share. In the past nine quarters, the company has beat estimates each time.

TipRanks Black Friday Sale

- Claim 60% off TipRanks Premium for the data-backed insights and research tools you need to invest with confidence.

- Subscribe to TipRanks' Smart Investor Picks and see our data in action through our high-performing model portfolio - now also 60% off

In addition, sales increased 10% year-over-year, with revenue hitting $2.2 billion compared to the $2.197 billion that analysts were looking for. This can be attributed to the company’s international, which grew 35% (40% on a constant dollar basis).

In addition, gross profits increased by 11%, which means that the company demonstrated operating leverage since it increased more than revenue. Indeed, the gross margin increased from 57.5% to 57.7%.

Looking forward, management now expects revenue and adjusted earnings per share for FY 2024 to be in the ranges of $10.7 billion to $10.8 billion and $14.27 to $14.47, respectively. For reference, analysts were expecting $10.762 billion in revenue along with an adjusted EPS of $14.14.

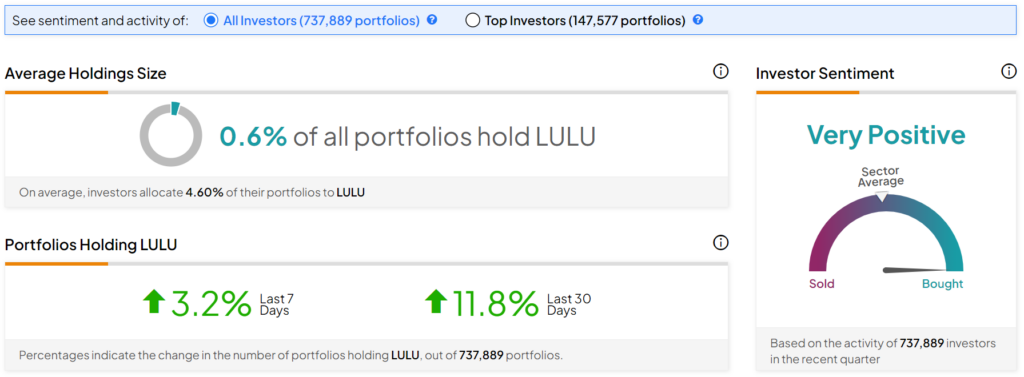

Investor Sentiment for LULU Stock Is Currently Very Positive

The sentiment among TipRanks investors is currently Very Positive. Out of the 737,889 portfolios tracked by TipRanks, 0.6% hold LULU stock. In addition, the average portfolio weighting allocated towards LULU among those who do have a position is 4.6%. This suggests that investors of the company are fairly confident about its future.

In addition, in the last 30 days, 11.8% of those holding the stock increased their positions. As a result, the stock’s sentiment is above the sector average, as demonstrated in the following image:

Is LULU a Good Stock to Buy?

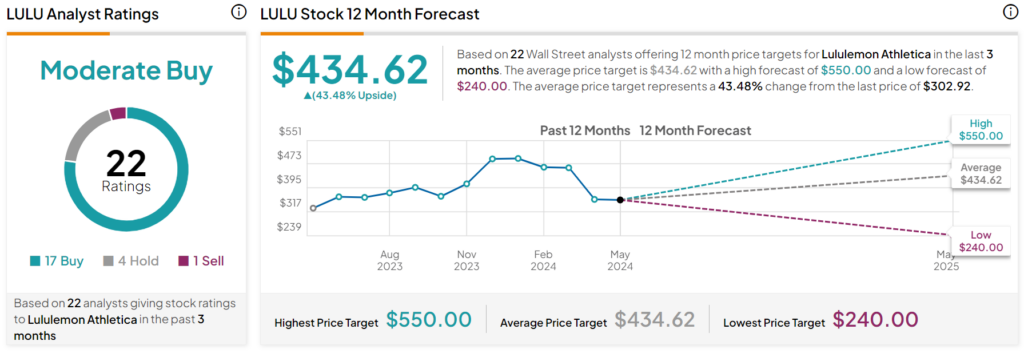

Turning to Wall Street, LULU has a Moderate Buy consensus rating based on 17 Buys, four Holds, and one Sell assigned in the past three months. After a 41% year-to-date decline, the average LULU price target of $434.62 per share implies 43.48% upside potential. However, it’s worth noting that estimates will likely change following today’s earnings report.