Electric vehicle (EV) maker Lucid Group (LCID) reported about a 47% year-over-year jump in its third-quarter deliveries to 4,078 vehicles, as customers rushed to make purchases before the end of the $7,500 federal tax credit. However, the company still fell short of the Street’s expectation of 4,286 vehicles. Recently, larger rival Tesla (TSLA) announced better-than-expected Q3 deliveries, thanks to the pull-forward in EV demand as buyers took advantage of the soon-to-expire EV tax credit.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Lucid’s Q3 Numbers and the Road Ahead

Lucid produced 3,891 vehicles in Q3 2025, with more than 1,000 additional vehicles built for Saudi Arabia for final assembly. Overall, the company produced 9,966 vehicles in the first nine months of 2025, excluding additional vehicles in transit to Saudi Arabia for final assembly. Lucid delivered 10,496 vehicles in the first three quarters of the year.

Looking ahead, many EV players are now bracing for a significant decline in Q4 2025 deliveries, as the expiration of the federal tax credit is expected to impact demand. While some EV players have slashed prices, automakers like General Motors (GM) and Ford (F) have devised other mechanisms to extend the benefits of the EV tax credit.

EV makers are already under pressure due to steep tariffs on vehicle imports and auto components. In August, Lucid lowered its 2025 production guidance to the range of 18,000 to 20,000 EVs, which many analysts believe is difficult to achieve due to ongoing challenges. All eyes are now on Lucid’s Gravity SUV, which is expected to drive deliveries in the fourth quarter of 2025.

What Is the Price Target for LCID Stock?

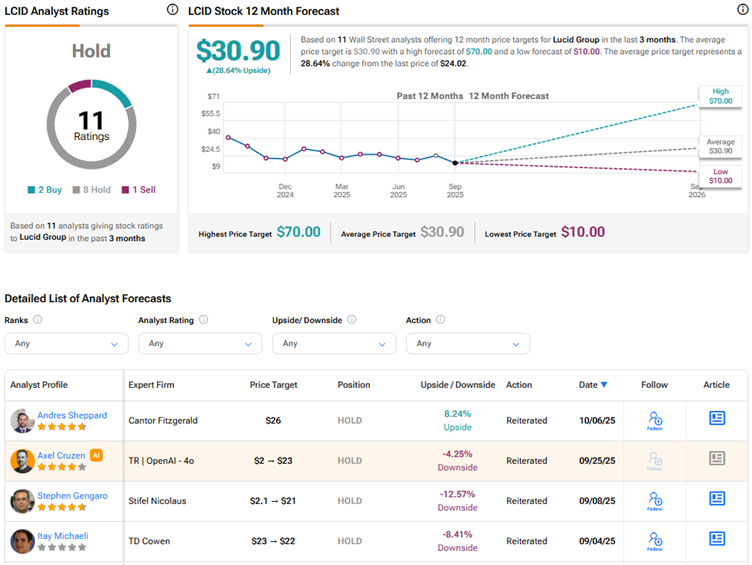

Currently, Wall Street has a Hold consensus rating on Lucid Group stock based on eight Holds, two Buys, and one Sell recommendation. The average LCID stock price target of $30.90 indicates 28.6% upside potential from current levels. LCID stock has risen more than 30% in the past month but is still down 20.5% year-to-date.