Lucid Group (LCID) shares fell about 7% on Wednesday after the electric vehicle maker announced a fresh $875 million convertible debt offering. This private sale to institutional investors has raised concerns about dilution and long-term financial pressure. LCID plans to issue senior convertible notes due in 2031, with an option to sell an additional $100 million within 13 days.

TipRanks Black Friday Sale

- Claim 60% off TipRanks Premium for the data-backed insights and research tools you need to invest with confidence.

- Subscribe to TipRanks' Smart Investor Picks and see our data in action through our high-performing model portfolio - now also 60% off

Lucid aims to use the proceeds to repurchase a portion of its 1.25% convertible senior notes due 2026 and extend its debt maturity profile.

While this move will help bolster its liquidity position, it raises red flags for investors already cautious of Lucid’s cash burn and slow ramp-up in vehicle deliveries.

It must be noted that Lucid ended Q3 with $1.6 billion in cash and over $2 billion in debt. Lucid’s largest shareholder, Saudi Arabia’s Public Investment Fund (PIF), has also agreed to expand its delayed draw term loan credit facility from $750 million to roughly $2 billion. Including this undrawn credit line, Lucid’s total liquidity now stands at about $5.5 billion.

What’s Next for Lucid?

Lucid’s future depends on scaling production, expanding its lineup, and using its partnership with the PIF to support growth. The Gravity SUV, set to hit the market in 2026, is expected to expand Lucid’s reach beyond luxury sedans and into the high-demand electric SUV segment.

However, rising competition in the EV space and persistent losses remain key challenges. Investors are likely to keep a close eye on Lucid as it launches the Gravity SUV and ramps up production in 2026.

Is LCID Stock a Good Buy?

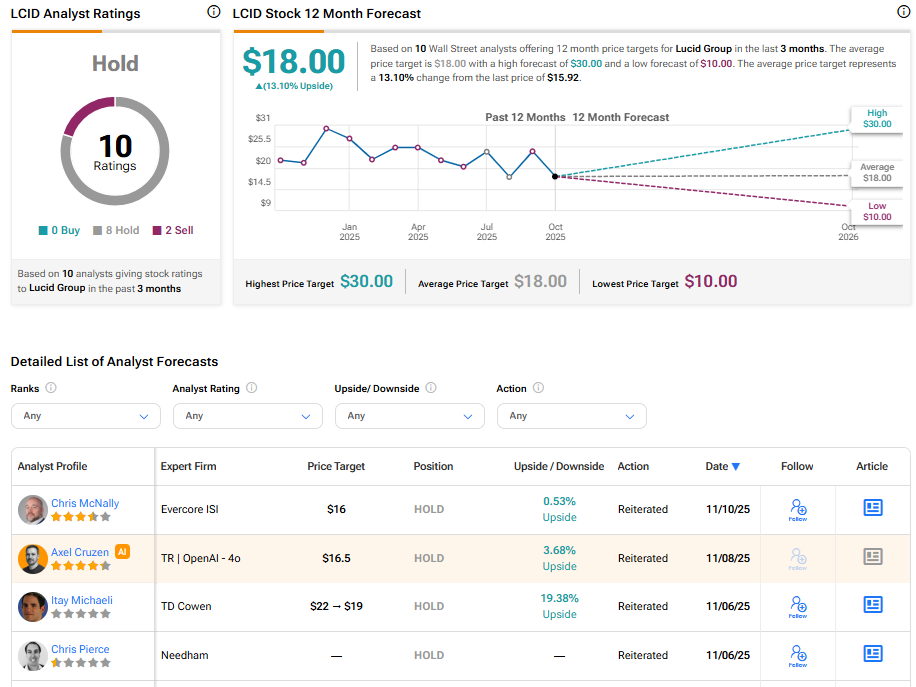

Turning to Wall Street, analysts have a Hold consensus rating on LCID stock based on eight Holds and two Sells assigned in the past three months. Further, the average Lucid stock price target of $18.00 per share implies 13.1% upside potential.