EV maker Lucid (LCID) is preparing to take on rival Tesla (TSLA) by developing a lower-priced electric crossover that will compete with the Model Y. Indeed, the vehicle, often referred to internally as “Project Midsize,” is expected to enter production in late 2026 with a starting price of around $50,000. This would be a major shift for Lucid, which has so far focused on higher-end luxury EVs. Importantly, the move is designed to help Lucid reach a much broader audience than its current lineup allows.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

To make the pricing work, Lucid plans to use its efficient Atlas drive unit along with a smaller and cheaper battery pack, while still targeting a driving range of more than 300 miles. The company believes that this balance of cost and efficiency could make the crossover competitive in a crowded segment. As a result, the $50,000 crossover is widely seen as a make-or-break moment for Lucid.

This is because relying only on luxury EVs has not generated the scale needed for sustained growth, according to analysts. In fact, Lucid has faced slower-than-expected momentum with its Gravity SUV and has already lowered production and delivery expectations. Therefore, by targeting a high-volume segment that’s dominated by Tesla’s Model Y, Lucid is betting it can go from a niche luxury brand to a more mainstream EV competitor.

Is LCID Stock a Good Buy?

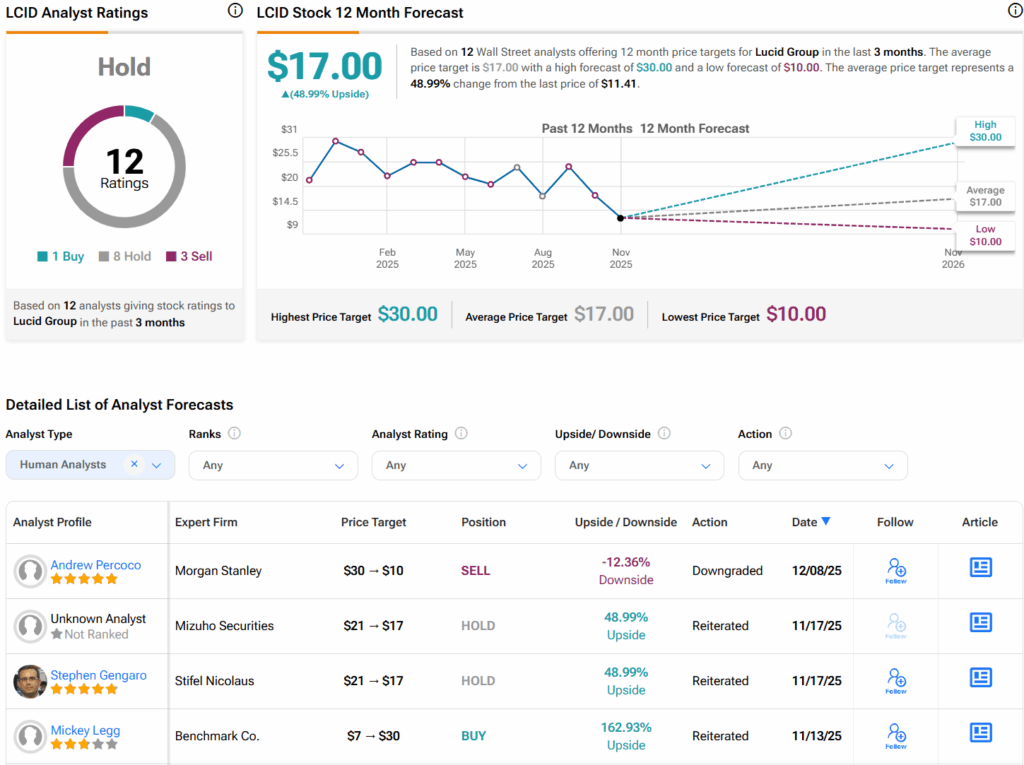

Turning to Wall Street, analysts have a Hold consensus rating on Lucid stock based on one Buy, eight Holds, and three Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average Lucid price target of $17 per share implies 49% upside potential.