Shares of EV maker Lucid (LCID) jumped nearly 10% at the time of writing after Morgan Stanley upgraded its rating from Sell to Hold. The investment firm sees the potential for Lucid’s to integrate artificial intelligence into its business strategy. Despite the upgrade, Morgan Stanley kept Lucid’s price target at $3 but raised its bull case scenario to $10.

Analyst Adam Jonas highlighted the company’s in-house innovations, which include its all-electric platform, proprietary powertrain technology, battery pack, and advanced software. These technologies position Lucid as a strong player in the EV industry, particularly as demand for high-performance electric drivetrains grows.

Jonas also pointed out that while Lucid can continue to license out its drivetrain technology to traditional automakers, its real value may come from forming partnerships with AI and advanced driver-assistance system (ADAS) companies. Collaborating with these tech firms could help Lucid improve autonomous driving capabilities and establish itself as a leader in EV development.

What Is a Good Price for LCID Stock?

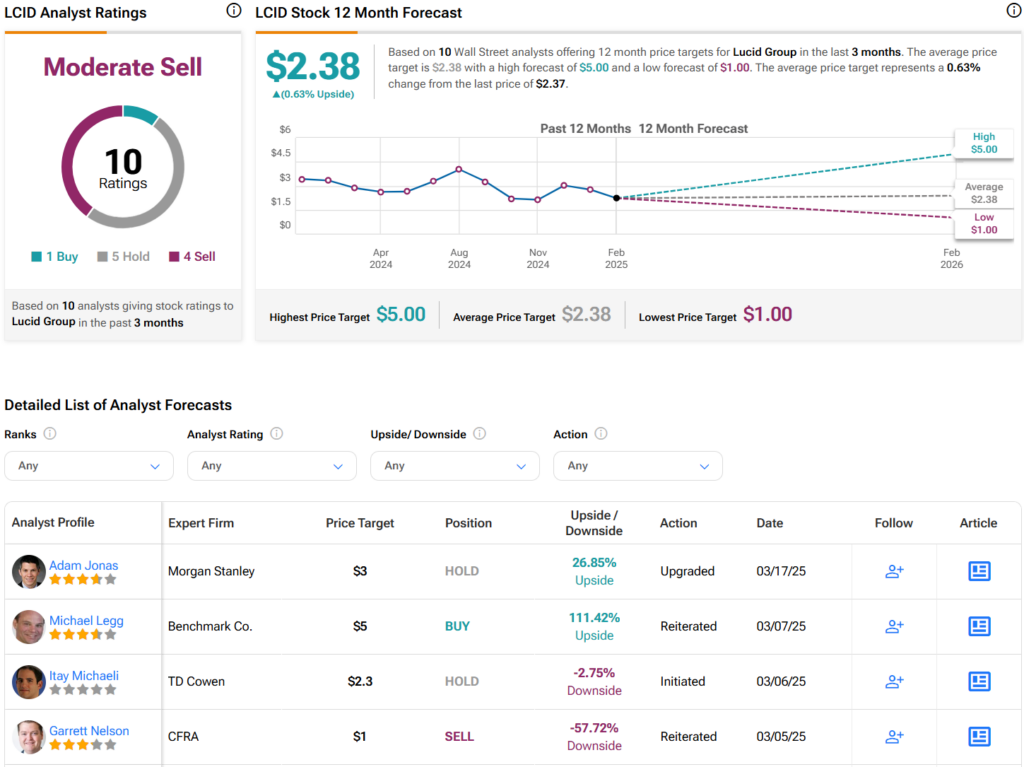

Turning to Wall Street, analysts have a Hold consensus rating on LCID stock based on one Buy, five Holds, and four Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average LCID price target of $2.38 per share implies 0.63% upside potential.

Questions or Comments about the article? Write to editor@tipranks.com