Lucid Group (LCID) saw a meaningful increase in both production and deliveries last year as it continued to scale the manufacturing of its new Gravity SUV. The electric vehicle maker reported total deliveries of 15,841 vehicles, which was 55% higher than in 2024. Notably, growth picked up sharply toward the end of the year, with fourth-quarter deliveries jumping by more than 70% compared with the same period a year earlier, driven by stronger production momentum.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The company also hit its revised production target for 2025. After cutting its original goal from as many as 20,000 vehicles, Lucid produced 18,378 vehicles for the year, including 8,412 units in the fourth quarter. Lucid has said that much of this increase came from the gradual ramp-up of the Gravity SUV, though the process has been slowed at times by supply chain shortages and other operational challenges.

Nevertheless, even with this progress, Lucid continues to face a tough operating environment. Alongside its own production hurdles, the overall EV industry is dealing with rising costs tied to tariffs, slower expected growth in electric vehicle sales, and regulatory changes that are pressuring margins. The expiration of federal consumer EV incentives has also weighed on demand, meaning that while Lucid’s production trend is improving, the company still faces significant headwinds. Regardless, shares surged in today’s trading.

Is LCID Stock a Good Buy?

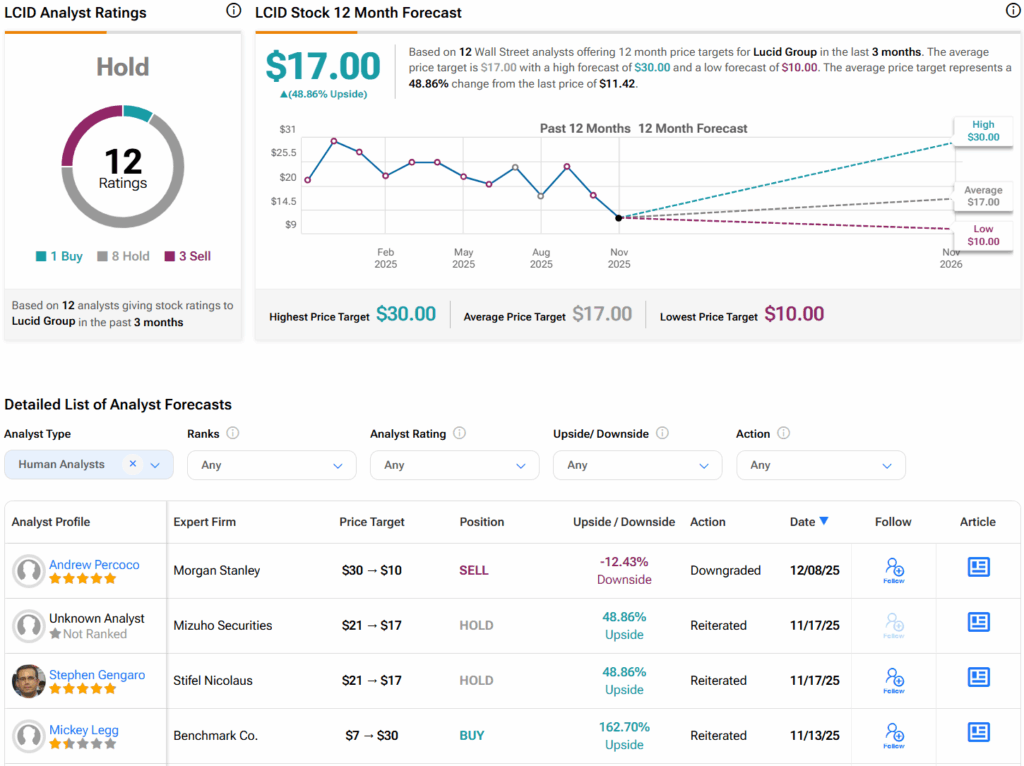

Turning to Wall Street, analysts have a Hold consensus rating on Lucid stock based on one Buy, eight Holds, and three Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average Lucid price target of $17 per share implies 48.9% upside potential.