Premium electric vehicle (EV) maker Lucid Group (LCID) is set to release its Q3 FY24 results on November 7. The Street expects Lucid to post a diluted loss of $0.31 per share, wider than last year’s $0.28 loss per share. Meanwhile, sales are expected to jump 42.4% year-over-year to $196.23 million, according to data from the TipRanks Forecast page.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

- Make smarter investment decisions with TipRanks' Smart Investor Picks, delivered to your inbox every week.

Lucid is a relatively newer company and is yet to make a quarterly profit. The company is going to start taking orders for its next flagship EV, Lucid Gravity.

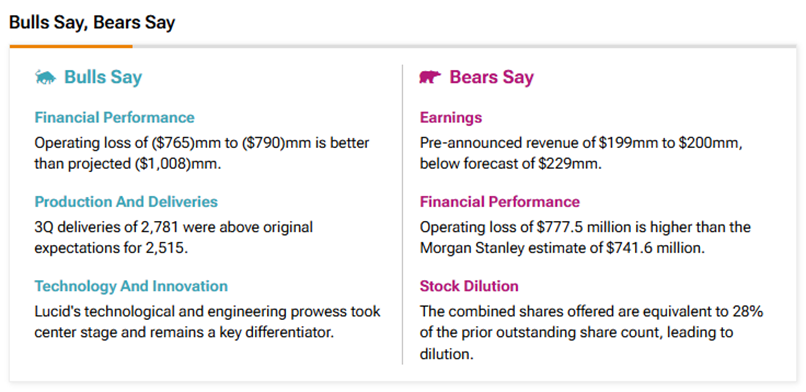

Insights from TipRanks’ Bulls Say, Bears Say Tool

The EV startup is facing a number of challenges, including increasing input costs and lagging production schedules. However, Lucid has been able to draw more and more capital from its largest investor, Saudi Arabia’s Public Investment Fund (PIF). Last week, PIF infused a further $1.03 billion into the company by purchasing 396 million LCID shares.

According to TipRanks’ Bulls Say, Bears Say tool, bulls are encouraged by Lucid’s improving operating loss, better-than-projected Q3 vehicle deliveries, and advanced technology.

On the other hand, bears are concerned about the EV maker’s continued operating losses, high share dilution, and slow revenue growth.

Options Traders Anticipate a Major Move

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. If this sounds complicated, don’t worry as the Options tool does this for you.

Indeed, it currently says that options traders are expecting a 17.33% move in either direction in LCID stock.

Is LCID Stock a Good Buy?

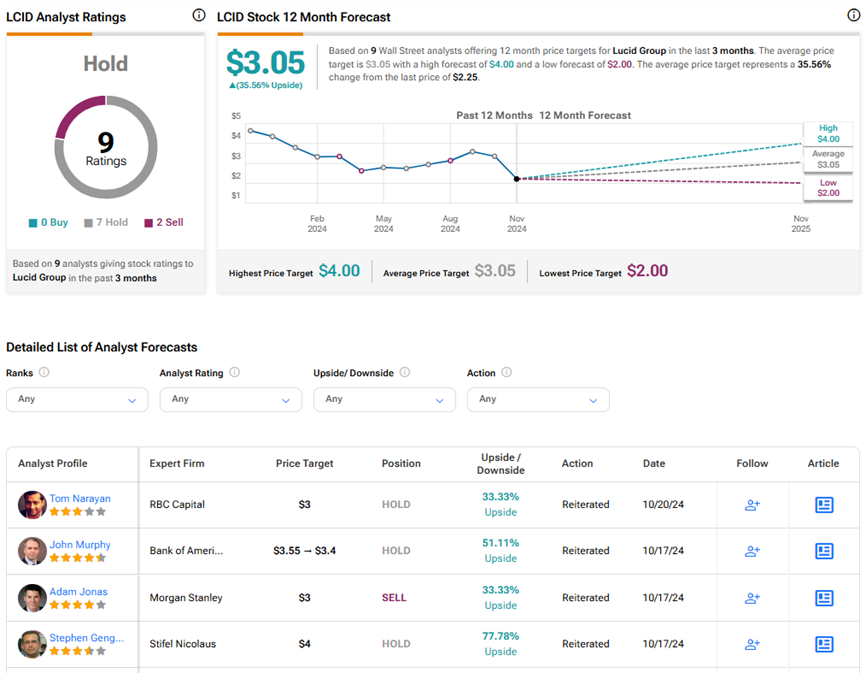

Amid the ongoing challenges, analysts prefer to remain on the sidelines on Lucid stock. On TipRanks, LCID stock has a Hold consensus rating based on seven Holds and two Sell ratings. Also, the average Lucid Group price target of $3.05 implies 35.6% upside potential from current levels. Year-to-date, LCID shares have lost 46.6%.