Luxury electric vehicle (EV) maker Lucid Group (LCID) will report its Q2 results on August 6. The stock gained over 36% on Thursday after the company announced a new partnership with Uber (UBER) and autonomous tech startup Nuro. The three companies plan to deploy 20,000 Lucid Gravity SUVs, equipped with Nuro’s self-driving technology, on Uber’s network over the next six years.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

- Make smarter investment decisions with TipRanks' Smart Investor Picks, delivered to your inbox every week.

Following the news, Top Morgan Stanley analyst Adam Jonas reiterated a Hold rating on Lucid with a $3.00 price target. Four-star analyst Adam Jonas believes the Uber-Nuro deal shows that Lucid is expanding its focus beyond EVs and starting to pursue “AI-enabled autonomy” through strategic partnerships.

Analyst Sees Long-Term Value in the Uber Deal

Jonas highlighted Lucid’s upcoming Gravity SUV as a key part of the company’s next growth phase. He believes the deal shows Lucid’s potential to play a bigger role in the AI and self-driving space.

As part of the deal, Uber will invest $300 million in Lucid. While the amount is relatively small compared to Lucid’s ongoing cash needs, Jonas believes it could provide short-term support as Lucid works to ramp up Gravity production.

Although Morgan Stanley remains cautious on the stock, the firm views the deal as an important step that could lead to more partnerships in AI, EV technology, and global markets, helping Lucid strengthen its position in the fast-growing autonomous driving space.

What’s Ahead for Lucid Stock?

Looking ahead into the Q2 earnings season, Wall Street forecasts a Q2 2025 loss of $0.22 per share, an improvement from the $0.34 per share loss in the same quarter last year. Meanwhile, revenues are expected to rise by 41% from the same quarter last year, reaching $283.2 million, according to data from the TipRanks Forecast page.

Investors will be watching closely for updates on Gravity production, spending levels, and any early signs of revenue growth tied to these new partnerships.

Is LCID Stock a Buy?

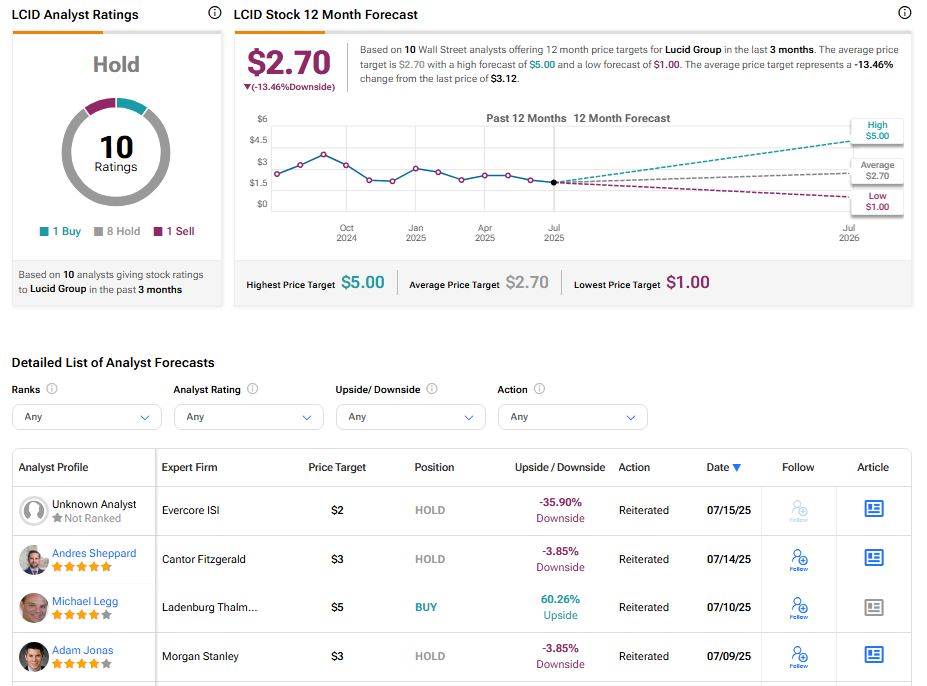

The stock of Lucid Group has a consensus Hold rating among ten Wall Street analysts. That rating is currently based on one Buy, eight Hold, and one Sell recommendations issued in the past three months. The average LCID price target of $2.70 implies 13.46% downside from current levels.