Lowe’s Companies (LOW) disappointed investors with its soft guidance and a mixed report in the second quarter. The home improvement retailer now expects FY24 sales to be in the range of $82.7 billion to $83.2 billion, compared to its prior forecast between $84 billion and $85 billion. The company now anticipates that comparable sales will decline between 3.5% and 4% year-over-year due to a “pressured macroeconomic environment.”

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Furthermore, it has now projected adjusted earnings between $11.70 and $11.90 per share, compared to its prior forecast in the range of $12 to $12.30 per share. For reference, analysts had estimated earnings of $12.09 per share on revenues of $84.2 billion.

LOW’s Q2 Results

In the second quarter, the retailer reported adjusted earnings of $4.10 per share, exceeding analysts’ expectations of $3.98 per share. The company’s Q2 revenues declined by 5.6% year-over-year to $23.6 billion, falling short of consensus estimates of $24.01 billion.

Lowe’s comparable sales declined by 5.1% in the second quarter as consumers spent less on big-ticket do-it-yourself projects and unfavorable weather impacted seasonal and outdoor categories. This was partially offset by positive sales in the Pro and Online segments. Lowe’s Pro business segment specifically caters to contractors, repair remodelers, and specialty tradesmen.

Indeed, according to the TipRanks “Bulls Say, Bears Say,” analysts bullish on LOW stock approve of the operational efficiency of its Pro business segment that has resulted in better servicing “the small and medium-sized pro [market] and gain share including its pro rewards program, pro inventory, and piloting some solutions for larger order job site delivery.”

Is LOW Stock a Buy or Sell?

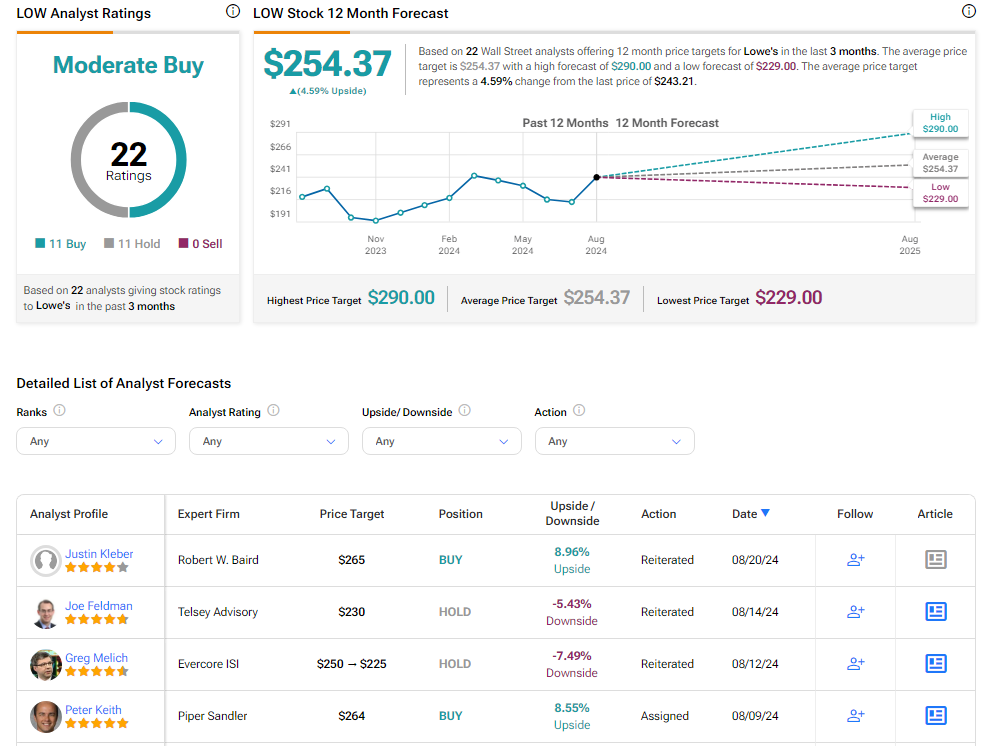

Analysts remain cautiously optimistic about LOW stock, with a Moderate Buy consensus rating based on 11 Buys and Holds each. Over the past year, LOW has increased by more than 14%, and the average LOW price target of $254.37 implies an upside potential of 4.6% from current levels. These analyst ratings are likely to change following LOW’s results today.