Loop Capital Markets analyst Mark Schappel has reaffirmed his Buy rating on Palantir Technologies (PLTR) stock, even though he lowered the price target to $125 from $141. The optimism follows a private meeting with PLTR’s CFO David Glazer and his finance team, which bolstered the top-rated analyst’s view of Palantir as a leader in enterprise AI.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The meeting provided insights into Palantir’s artificial intelligence platform (AIP) through a product demo. Discussions also involved current AI industry trends, competition, spending priorities, and PLTR’s “bootcamp” go-to-market strategy, which focuses on building deep relationships with clients.

Analyst Confident in PLTR’s Leadership in Enterprise AI

At the meeting’s conclusion, Schappel was even more confident about PLTR stock’s future. He believes Palantir is emerging as a key player in enterprise AI. The analyst noted that the enterprise AI sector is in a growing phase where small-scale pilot programs are now expanding into full-scale production.

Moreover, the analyst expects the use of AI across various industries to grow rapidly, solidifying PLTR’s position as a key player in this expanding market.

PLTR Boosts Market Confidence with New Customers

In other positive news, Palantir recently disclosed the addition of several customers, including Walgreens Boots Alliance (WBA), Heineken (HEINY), convenience store operator RaceTrac, and data digitization firm Ripcord. These new partnerships reflect PLTR’s ability to cater across industries, from retail to data management.

In addition to new customers, Palantir said it continues to work with existing clients like AT&T (T), Delta Air Lines (DAL), and JD Power.

The positive momentum from this news resulted in a 7.2% jump in Palantir stock price during yesterday’s trading session, reflecting investor confidence in the company’s potential for sustained growth.

Is PLTR a Good Stock to Buy?

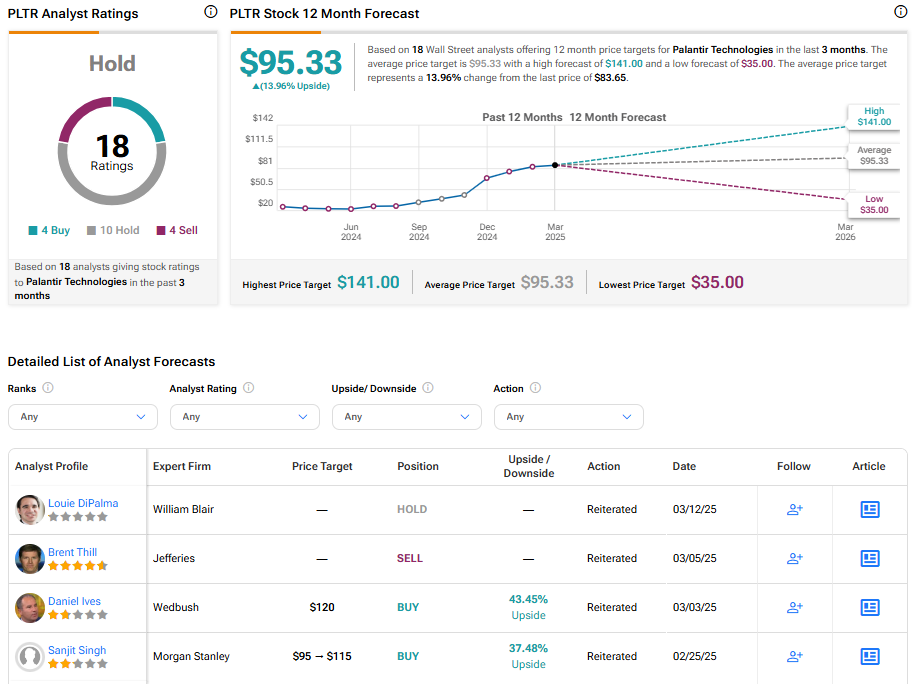

Turning to Wall Street, PLTR stock has a Hold consensus rating based on four Buys, 10 Holds, and four Sells assigned in the last three months. At $95.33, the average Palantir stock price target implies 13.96% upside potential.