The Dow Jones Industrial Average Index (DJIA) consists of 30 top companies from sectors such as Technology, Healthcare, Finance, and Consumer Goods. The Dow Jones is often seen as a stable investment option due to its focus on well-established companies. Recently, the index has faced volatility due to concerns about trade tensions and recession risks. To gain exposure to the Dow Jones, investors may consider investing in these two ETFs: SPDR Dow Jones Industrial Average ETF Trust (DIA) and Invesco Dow Jones Industrial Average Dividend ETF (DJD).

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Let’s take a deeper look at these two ETFs.

SPDR Dow Jones Industrial Average ETF Trust

The DIA ETF is the most popular ETF tracking the Dow Jones, holding all 30 stocks in the index. Managed by State Street Global Advisors, DIA provides investors with a cost-efficient and liquid way to invest in the Dow as a single security.

Overall, the ETF has $37.34 billion in assets under management (AUM) and an expense ratio of 0.16%. Over the past year, the DIA ETF has gained 6.84%.

On TipRanks, DIA has a Moderate Buy consensus rating based on 29 Buys and two Holds assigned in the last three months. At $492.16, the average DIA ETF price target implies 18.42% upside potential.

Invesco Dow Jones Industrial Average Dividend ETF

The DJD ETF focuses on dividend-paying stocks in the Dow Jones. It gives more weight to companies with higher payouts based on their dividends from the past year. Importantly, only stocks with consistent dividend payments over the previous 12 months are included in the index.

Overall, the ETF has $340.64 million in AUM. Additionally, it has an expense ratio of 0.07%. The DJD ETF has returned 11.96% in the past 12 months.

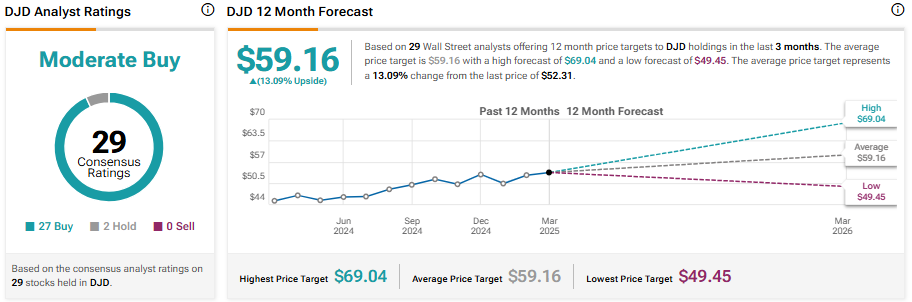

Turning to Wall Street, the ETF has a Moderate Buy consensus rating. Of the 29 stocks held, 27 have Buys and two have a Hold rating. At $59.16, the average DJD ETF price target implies a 13.09% upside potential.

Concluding Thoughts

ETFs provide indirect exposure to the Dow Jones, reducing risk compared to investing directly in the stock. Furthermore, ETFs are a liquid and transparent way to participate in the market. Investors seeking ETF recommendations might consider DIA and DJD, as these ETFs offer exposure to the index.