Rigetti Computing (RGTI) stock has gained over 808.5% over the past three months. This stellar performance is driven by advancements in quantum computing technology, such as the launch of its 84-qubit Ankaa-3 quantum computer. Also, partnerships with companies like Nvidia (NVDA) and Quantum Machines, a manufacturer of quantum control systems, have bolstered Rigetti’s growth prospects. To gain exposure to RGTI stock, investors may consider investing in these two ETFs: Invesco DWA Technology Momentum ETF (PTF) and Defiance Quantum ETF (QTUM).

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Let’s take a deeper look at these two ETFs.

Invesco DWA Technology Momentum ETF

The PTF ETF tracks the performance of the Dorsey Wright Technology Technical Leaders Index, which includes about 30 tech companies with strong momentum characteristics. The fund invests at least 90% of its assets in the securities that make up this index. It is worth noting that RGTI accounts for 6.71% of PTF’s total holdings. Also, the ETF includes some other top companies, such as AppLovin (APP), Apple (AAPL), and Palantir (PLTR).

Overall, the ETF has $580.76 million in assets under management (AUM) and an expense ratio of 0.6%. Over the past six months, the PTF ETF has generated a return of 12.17%.

On TipRanks, PTF has a Moderate Buy consensus rating based on 37 Buys and eight Holds assigned in the last three months. At $84.40, the average PTF ETF price target implies 15.34% upside potential.

Defiance Quantum ETF

The QTUM ETF provides investors with exposure to the rapidly growing quantum computing and AI sectors. The ETF tracks the BlueStar Machine Learning and Quantum Computing Index (BQTUM), which includes companies that derive at least 50% of their revenue from these businesses. Importantly, RGTI stock constitutes 2.27% of the ETF’s holdings. Apart from RGTI, some of the top stocks in the QTUM ETF are D-Wave Quantum (QBTS), IonQ (IONQ), and Alibaba (BABA).

Overall, the ETF has $1.12 billion in AUM. Additionally, it has an expense ratio of 0.4%. The QTUM ETF has returned 36.89% in the past six months.

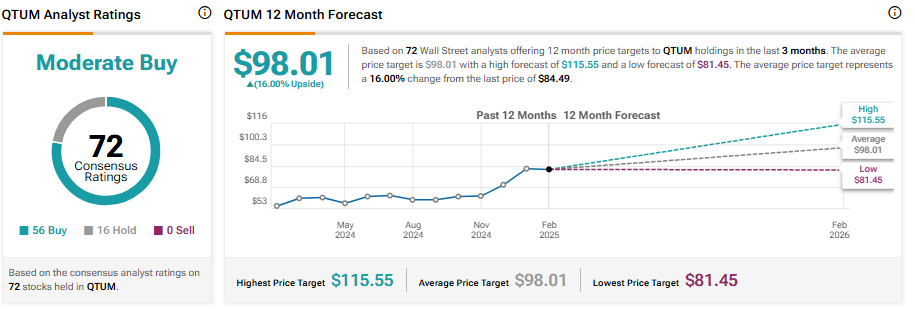

Turning to Wall Street, the ETF has a Moderate Buy consensus rating. Of the 72 stocks held, 56 have Buys and 16 have a Hold rating. At $98.01, the average QTUM ETF price target implies a 16% upside potential.

Concluding Thoughts

ETFs provide indirect exposure to RGTI, reducing risk compared to investing directly in the stock. Furthermore, ETFs are a liquid and transparent way to participate in the market. Investors seeking ETF recommendations might consider PTF and QTUM, as these ETFs offer exposure to RGTI stock.