PayPal Holdings’ (PYPL) strategic initiatives and expanding digital payments market make its growth prospects look promising. Its efforts to enhance core payment services and diversify into areas like cryptocurrency and value-added services for merchants are impressive. Looking ahead, PYPL’s ability to adapt to market trends, such as AI-driven financial tools, positions it well for long-term success. To invest in PYPL, investors may consider these two ETFs: Global X Fintech ETF (FINX) and REX Crypto Equity Premium Income ETF (CEPI).

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

It is worth mentioning that PYPL is scheduled to report its Q1 results on April 29. Currently, analysts expect PayPal to report Q1 earnings per share (EPS) of $1.16, up 7.4% from the prior-year quarter. Also, the company’s revenue is expected to increase 1.4% to $7.85 billion in the first quarter.

Let’s take a deeper look at these two ETFs.

Global X Fintech ETF

The FINX ETF invests in companies improving traditional financial services with advancements in mobile payments, digital wallets, blockchain, and online lending. It tracks the performance of the Indxx Global FinTech Thematic Index. Importantly, PYPL stock makes up 5.93% of the holdings in the FINX ETF.

Some of the top holdings in FINX ETF include Intuit (INTU), Fiserv (FI), and Coinbase Global (COIN). Further, the ETF has $245.46 million in assets under management (AUM) and has an expense ratio of 0.68%. It is worth noting that the ETF has gained 2% in the past year.

Overall, the FINX ETF has a Moderate Buy consensus rating. Of the 63 stocks held, 47 have Buys, 15 have a Hold, and one has a Sell rating. At $35.42, the average FINX ETF price target implies a 27.99% upside potential.

REX Crypto Equity Premium Income ETF

The CEPI ETF is an innovative fund that combines investments in crypto-related stocks with a covered call strategy to generate premium income. Launched in December 2024, the ETF aims to provide both capital appreciation and current income. PayPal stock constitutes 4.39% of the holdings in the ETF.

Some of the other holdings in CEPI ETF include Robinhood Markets (HOOD), Strategy (MSTR), and Mastercard (MA). Also, the ETF has $29.03 million in AUM and has an expense ratio of 0.85%. The ETF has declined 20% in the past year.

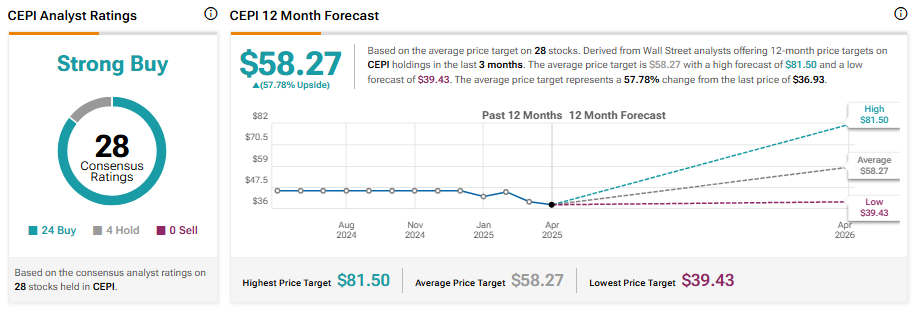

On TipRanks, CEPI has a Strong Buy consensus rating based on 24 Buys and four Holds assigned in the last three months. At $58.27, the average CEPI ETF price target implies 57.78% upside potential.

Concluding Thoughts

ETFs provide a diversified way to invest in PayPal, reducing risk compared to investing directly in the stock. Furthermore, ETFs are a low-cost, liquid, and transparent way to participate in the market. Investors seeking ETF recommendations might consider FINX and CEPI, as these ETFs offer significant exposure to PYPL stock.