BigBear.ai (BBAI) stock has gained over 123.7% in the past six months due to its expanding role in defense and AI-driven solutions. The company bagged a $13.2 million deal with the U.S. Department of Defense to modernize its force management platform. Also, BBAI’s ConductorOS platform was deployed in military exercises, reflecting its rising influence in advanced AI and data coordination. To gain exposure to BBAI stock, investors may consider investing in these two ETFs: iShares Russell 2000 ETF (IWM) and Themes Generative Artificial Intelligence ETF (WISE).

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Let’s take a deeper look at these two ETFs.

iShares Russell 2000 ETF

The IWM ETF tracks the performance of the Russell 2000 Index, which represents the smallest 2,000 companies in the Russell 3000 Index. This ETF provides exposure to U.S. small-cap stocks, offering diversification across various sectors, such as Financials, Healthcare, and Industrials.

Overall, the ETF has $63.99 billion in assets under management (AUM) and an expense ratio of 0.19%. Over the past six months, the IWM ETF has declined 7%.

On TipRanks, IWM has a Moderate Buy consensus rating based on 1,290 Buys, 598 Holds, and 54 Sells assigned in the last three months. At $274.45, the average IWM ETF price target implies 33.59% upside potential.

Themes Generative Artificial Intelligence ETF

The WISE ETF tracks the Solactive Generative Artificial Intelligence Index (SOLGAIN), which focuses on companies involved in AI-related industries such as data analytics, natural language processing, and AI-driven services.

Overall, the ETF has $25.9 million in AUM. Additionally, it has an expense ratio of 0.35%. The WISE ETF has returned 17.4% in the past six months.

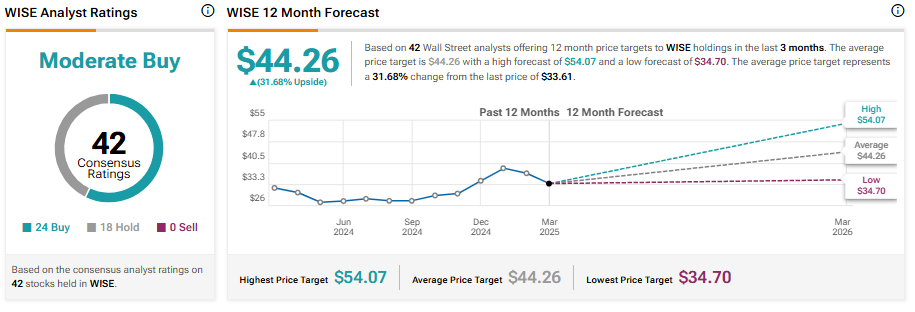

Turning to Wall Street, the ETF has a Moderate Buy consensus rating. Of the 42 stocks held, 24 have Buys and 18 have a Hold rating. At $44.26, the average WISE ETF price target implies a 31.68% upside potential.

Concluding Thoughts

ETFs provide indirect exposure to BBAI, reducing risk compared to investing directly in the stock. Furthermore, ETFs are a liquid and transparent way to participate in the market. Investors seeking ETF recommendations might consider WISE and IWM, as these ETFs offer exposure to BBAI stock.