AST SpaceMobile (ASTS) stock gained about 16% on Wednesday after the company disclosed successful assembly and testing of its BlueBird 6 satellite. The rally was further fueled by Barclays raising its price target to $60, citing AST’s potential to offer richer connectivity compared to rivals. Thus, this might be the right time to consider ASTS stock, especially through exchange-traded funds (ETFs) that offer diversified exposure without the risk of holding the stock directly.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Investors seeking exposure to ASTS stock may consider the Procure Space ETF (UFO) and the SPDR S&P Telecom ETF (XTL). Let’s take a deeper look at these two ETFs.

Procure Space ETF

The UFO ETF tracks the S-Network Space Index. This index includes companies generating at least 50% of their revenue from space-related businesses, such as satellite communications, rocket manufacturing, and geospatial technology.

Some of the top holdings in the UFO ETF include Planet Labs (PL), Garmin (GRMN), and Rocket Lab (RKLB). Overall, the ETF has $117.27 million in assets under management (AUM) and an expense ratio of 0.94%. Over the past six months, the UFO ETF has generated a return of 59.9%.

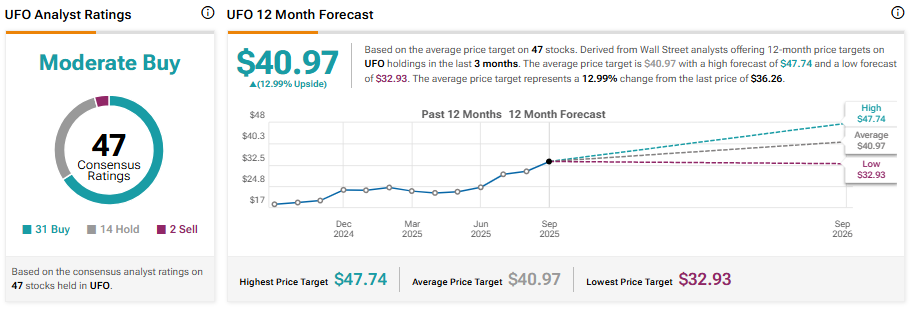

On TipRanks, UFO ETF has a Moderate Buy consensus rating based on 31 Buys, 14 Holds, and two Sells assigned in the last three months. At $40.97, the average UFO ETF price target implies 12.99% upside potential.

SPDR S&P Telecom ETF

The XTL ETF invests in the U.S. telecommunications sector by tracking the S&P Telecom Select Industry Index. It takes an equal-weighted approach, giving balanced exposure across small, mid, and large-cap telecom and communication equipment companies.

Apart from ASTS, some of the top stocks in the XTL ETF are Ciena (CIEN), Cogent (CCOI), and Verizon (VZ). Overall, the ETF has $159.59 million in AUM. Also, it has an expense ratio of 0.35%. The XTL ETF has returned 37.5% in the past six months.

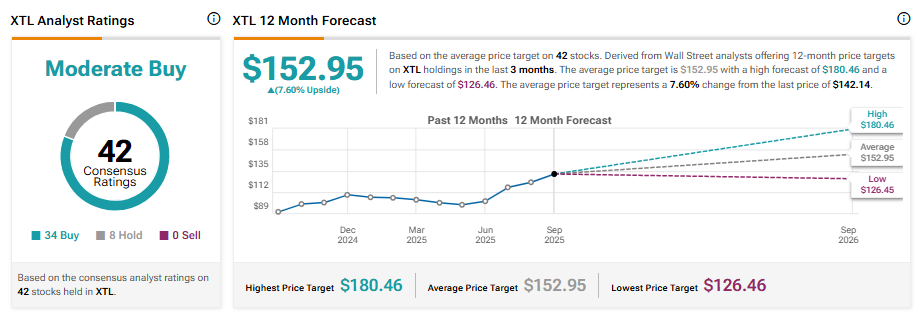

Turning to Wall Street, the ETF has a Moderate Buy consensus rating. Of the 42 stocks held, 34 have Buy ratings and eight have Hold ratings. At $152.95, the average XTL ETF price target implies a 7.6% upside potential.

Concluding Thoughts

ETFs provide indirect exposure to ASTS, reducing risk compared to investing directly in the stock. Furthermore, ETFs are a liquid and transparent way to participate in the market. Investors seeking ETF recommendations might consider UFO and XTL, as these ETFs offer exposure to AST SpaceMobile stock.