Archer Aviation (ACHR) is set to report its Q3 earnings on November 6. The electric vertical takeoff and landing (eVTOL) startup has made headlines with high-profile partnerships and patent acquisitions, which reflect its long-term potential. Thus, this may be the right time for investors to consider ACHR stock, especially through exchange-traded funds (ETFs) that offer diversified exposure without the risk of holding the stock directly.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Investors seeking exposure to ACHR stock may consider the ARK Space Exploration & Innovation ETF (ARKX) and the SPDR S&P Aerospace & Defense ETF (XAR). Let’s take a deeper look at these two ETFs.

ARK Space Exploration & Innovation ETF

The ARKX ETF is an actively managed fund that gives exposure to companies driving innovation in space, aerospace, and related technologies. Apart from ACHR stock, the ETF provides exposure to other major players such as Rocket Lab (RKLB), Kratos Defense & Security (KTOS), and AeroVironment (AVAV). Importantly, ACHR accounts for 5.76% of the ARKX ETF’s total holdings.

Overall, the ETF has $531.06 million in assets under management (AUM). Also, it has an expense ratio of 0.75%. Over the past three months, the ARKX ETF has generated a return of 17.98%.

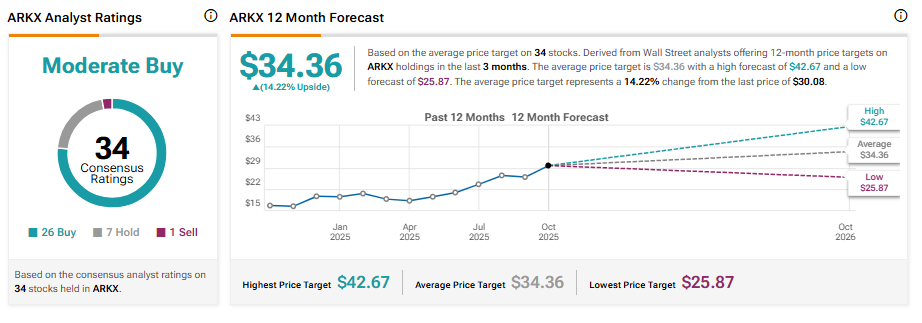

On TipRanks, ARKX has a Moderate Buy consensus rating based on 26 Buys, seven Holds, and one Sell assigned in the last three months. At $34.36, the average ARKX ETF price target implies 14.22% upside potential.

SPDR S&P Aerospace & Defense ETF

The XAR ETF offers exposure to U.S. companies in the aerospace and defense sectors and is popular among investors seeking to capitalize on military spending, space innovation, and aviation growth. Importantly, Archer Aviation accounts for 4.07% of the XAR ETF’s total holdings.

Apart from ACHR stock, some of the top stocks in the XAR ETF are RTX (RTX), AeroVironment, and ATI (ATI). The ETF has $4.83 billion in AUM and an expense ratio of 0.35%. The XAR ETF has gained 13.97% in the past three months.

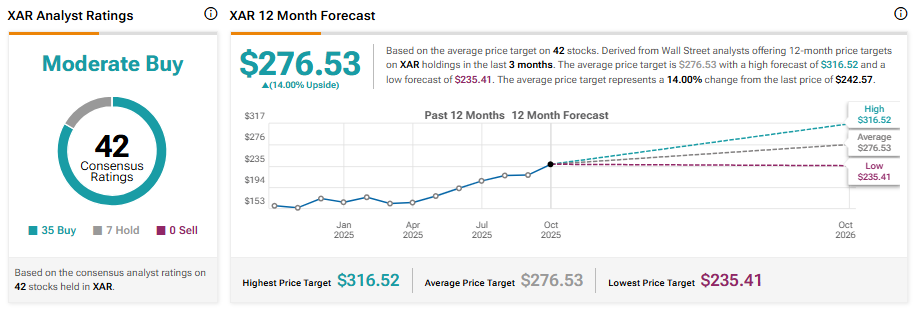

Turning to Wall Street, the ETF has a Moderate Buy consensus rating. Of the 42 stocks held, 35 have Buys and seven have Holds. At $276.53, the average XAR ETF price target implies a 14% upside potential.

Concluding Thoughts

ETFs provide indirect exposure to Archer Aviation stock, reducing risk compared to investing directly in the stock. Furthermore, ETFs are a liquid and transparent way to participate in the market. Investors seeking ETF recommendations might consider ARKX and XAR, as these ETFs offer exposure to ACHR stock.