Advanced Micro Devices (AMD) is well poised for growth backed by its strong presence in the AI and data center markets. Further, the company’s strong offerings, such as the MI300 series GPUs designed for AI training, are expected to bolster its market share. To gain exposure to AMD stock, investors may consider investing in these two ETFs: iShares Semiconductor ETF (SOXX) and VanEck Video Gaming and eSports ETF (ESPO).

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

iShares Semiconductor ETF

The SOXX ETF tracks the performance of the NYSE Semiconductor Index, providing investors with exposure to the semiconductor sector. This sector stands to benefit from trends such as growing AI demand. It is worth noting that AMD accounts for 6.77% of SOXX’s total holdings. Also, the ETF includes other top semiconductor companies, such as Broadcom (AVGO), Qualcomm (QCOM), and Nvidia (NVDA).

Overall, the ETF has $13.25 billion in assets under management (AUM) and an expense ratio of 0.35%. Over the past three months, the SOXX ETF has generated a return of 2.27%.

On TipRanks, SOXX has a Moderate Buy consensus rating based on 24 Buys and seven Holds assigned in the last three months. At $257.68, the average SOXX ETF price target implies 15.63% upside potential.

VanEck Video Gaming and eSports ETF

The ESPO ETF provides investors with exposure to the video gaming and esports industry. This ETF aims to replicate the performance of the MVIS Global Video Gaming and eSports Index. Importantly, AMD stock constitutes 7.49% of the ETF’s holdings. Apart from AMD, some of the top stocks in the ESPO ETF are Tencent (TCEHY), AppLovin (APP), and NetEase (NTES).

Overall, the ETF has $310.34 million in AUM. Additionally, it has an expense ratio of 0.56%. The ESPO ETF has returned 18.47 in the past three months.

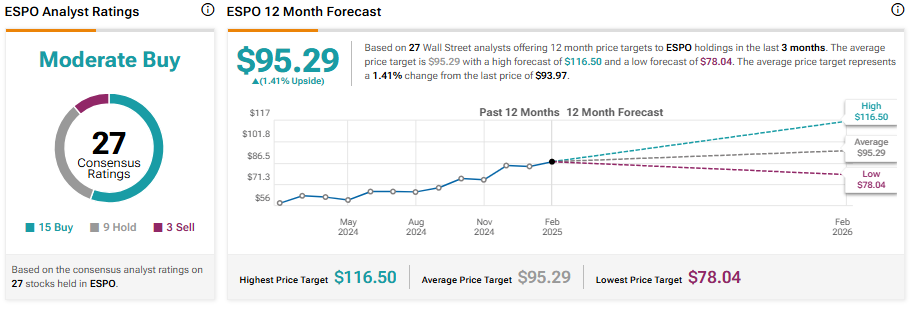

Turning to Wall Street, the ETF has a Moderate Buy consensus rating. Of the 27 stocks held, 15 have Buys, nine have a Hold rating, and three have a Sell. At $95.29, the average ESPO ETF price target implies a 1.41% upside potential.

Concluding Thoughts

ETFs provide indirect exposure to AMD, reducing risk compared to investing directly in the stock. Furthermore, ETFs are a liquid and transparent way to participate in the market. Investors seeking ETF recommendations might consider ESPO and SOXX, as these ETFs offer exposure to AMD stock.