With artificial intelligence commanding the spotlight, the natural reaction is to grab a piece of the pie. However, investors interested in AI should instead consider NexGen Energy (NXE). Specializing in the exploration and development of uranium properties, NexGen seems far removed from the tech ecosystem. While the relationship is tangential, the relevance is not, especially because of the extraordinary power consumption of advanced innovations. As such, I am bullish on NXE stock as a speculative trade.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The Numbers in Context Could Make NXE Stock Enticing

At first glance, NXE stock seems interesting enough. Even without the power consumption narrative, nuclear energy remains an important component of the broader infrastructure framework. From a psychological perspective, shares trade in the single digits, appearing rather “cheap.” Best of all, the analysts that do cover NexGen unanimously rate shares as a Buy.

However, a deeper look into the numbers raises some concerns. Currently, NexGen is a pre-revenue enterprise that operates in the upstream segment of the value chain. That said, Wall Street experts believe that by the end of Fiscal 2024, the uranium specialist can post sales of $1.47 million. Even better, the high-side estimate is $2.94 million.

Nevertheless, when stacked against its share count of 560.92 million, the projected sales multiple is extreme. Assuming a top line of $1.47 million, the multiple would come out to almost 3,000x. Mathematically, if NexGen manages to reach the most optimistic target, the sales would drop down dramatically. However, it would still be wildly elevated at 1,414x forward revenue.

To put this into context, nuclear energy peer Cameco (CCJ) features a price-to-sales ratio of over 12x. If NexGen were to achieve such a multiple – and assuming that the price of the security and the shares outstanding count remain the same – the company would need to generate roughly $346 million in revenue.

That might not happen anytime soon. Still, over the long run, should NexGen become successful with its upstream uranium endeavors, the valuation can start to look more reasonable.

Fundamentally, one of the biggest catalysts for NXE stock and the wider uranium industry is growing dependency on rather limited supply chain routes. By one study, the global uranium mining market may reach a valuation of $11.38 billion by 2030. That implies a compound annual growth rate of 4%.

Adding to the compelling framework for NXE stock is geopolitics. Basically, not every uranium producer stems from a politically stable or jurisdictionally friendly backdrop. For example, Kazakhstan is the top producer of the critical asset. Other nations, such as Uzbekistan, Russia and China, are also key players.

In other words, demand will likely soar for not only uranium supplies but also for uranium sourced from reliable partners. From the perspective of the U.S., it doesn’t get much more reliable than Canada, where NexGen is headquartered. So, NXE stock deserves to be on the radar.

Energy Consumption Makes NexGen a Must-Watch Trade

Of course, the other fundamental catalyst for NXE stock is the global AI arms race. Seemingly, everyone is attempting to extract new applications and avenues of productivity from digital intelligence. However, as I explained last month, AI isn’t free.

Sure, from the consumer’s perspective, utilizing large-language-model-powered chatbots to discover new recipes or to get help with your homework tends to be a cost-free endeavor. Behind the scenes, however, the amount of energy consumption is unprecedented. Due to AI and the proliferation of data centers, these technologies are imposing a strain on the national power grid.

TipRanks’ Paul Hoffman published a similar narrative regarding AI and the associated relevance boost for the nuclear energy industry. The expert wrote, “Nuclear power, with its renewed appeal due to low carbon emissions and round-the-clock reliability, appears ideally positioned to meet the skyrocketing power demands driven by AI.”

What’s more, the problem could get worse before it gets better. In a roundabout way, that was one of the concerns that Goldman Sachs (GS) published. Essentially, the actual productivity gains from AI protocols are too limited relative to the energy consumed. Still, it’s unlikely that such warnings will by themselves stop the AI gold rush.

Given the commitment to developing the latest, greatest, and smartest systems, the reality is that society should anticipate more energy consumption, not less. Practically speaking, no other energy source has as much energy density as nuclear fuel. Therefore, NXE stock – while being extremely speculative – has a chance to rise in relevance.

Is NexGen Energy Stock a Buy, According to Analysts?

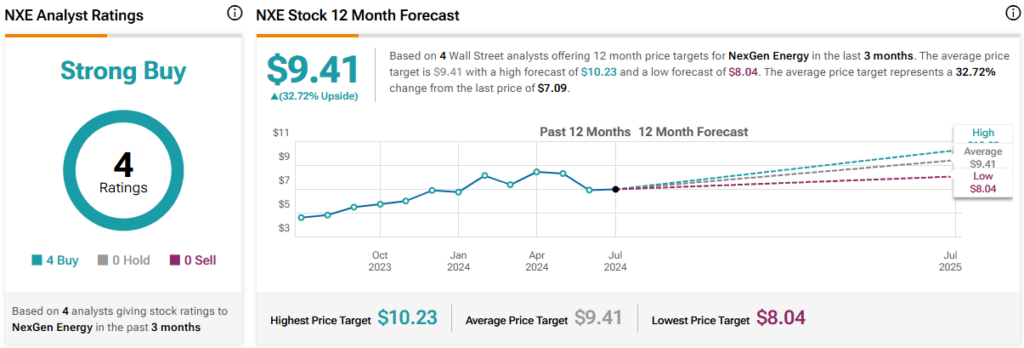

Turning to Wall Street, NXE stock has a Strong Buy consensus rating based on four Buys, no Holds, and zero Sell ratings. The average NXE stock price target is $9.41, implying 32.7% upside potential.

The Takeaway: NXE Stock Is Risky, But Rising Demand May Provide a Tailwind

Based purely on the numbers, NexGen Energy appears wildly speculative. Although nuclear energy has always been a relevant sector, NXE stock is overpriced relative to the small revenue it is projected to print. However, over the long run, rising demand for uranium – based largely on the stratospheric run of AI – suggests that even a speculative upstream player may have a shot at upside.