The excitement around Tesla (NASDAQ:TSLA) has been electric since its latest earnings call. Investors have clearly taken notice – shares have surged roughly 23% in the weeks following the release of the Q1 2025 report.

Unlike most companies, however, the shift in investor attitude was not due to cold, hard facts. Indeed, looking solely at its EV business, Tesla’s 2025 thus far has left a lot to be desired, with weakening sales and deliveries.

Though growing energy revenues were a bright spot, the spiking share price has been driven almost exclusively by CEO Elon Musk’s admission that he would be significantly ramping down his Washington, D.C.-related tasks to refocus on running Tesla.

One investor, known by the pseudonym Research Wise, believes that this is not nearly a good enough reason to remain enamored with Tesla.

“The recent stock surge is sentiment-driven, following Elon Musk’s announcement to return to Tesla, but the company’s expensive valuation and weak growth prospects make it unsustainable,” the investor opined.

Research Wise points out that the company’s lower EV volumes, pricing pressures, and increased expenses will combine to shrink margins going forward. Tesla’s brand has also been damaged by Musk’s rightwing political activities, which are contributing to softer demand.

While acknowledging Tesla’s growing energy business, Research Wise argues that it is simply not enough to stem the worrisome trends in the automotive segment, which accounts for the vast majority (~73%) of Tesla’s revenues.

The real bonanza – and the reason that TSLA enjoys such high valuations – is the AI-powered Full Self-Driving plans that Musk has been brandishing for years. Even here, Research Wise is not convinced that this will succeed in delivering the desired impact. The road to commercial adoption is long and winding, with plenty of “regulatory, geographic, and public trust challenges” up ahead.

In other words, don’t get seduced by the Musk bump. In fact, this moment could be the time to escape before further losses come around.

“The recent increase in the stock price presents a decent opportunity to exit,” concludes Research Wise, who, unsurprisingly, rates TSLA a Sell. (To watch Research Wise’s track record, click here)

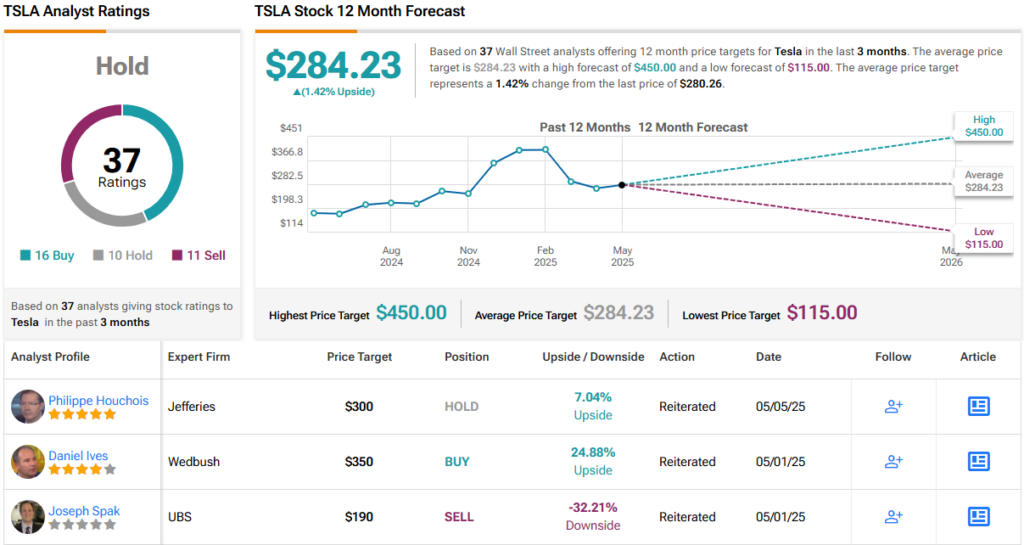

As for the broader Street, the excitement is muted. Out of 37 analysts covering the stock, 16 say Buy, 10 are sitting on the fence with Hold, and 11 are calling for a Sell – all coalescing into a Hold (i.e., Neutral) consensus rating. The average 12-month price target lands at $284.23, suggesting little upside from here. (See TSLA stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.