Visa (V) and Mastercard (MA) are once again under legal fire as a London tribunal ruled that their default multilateral interchange fees—charges applied to retailers each time a customer uses one of their cards—violate European competition law. These fees, set by Visa and Mastercard rather than negotiated individually, have long been criticized by retailers for being excessive and non-transparent. The latest ruling comes from the Competition Appeal Tribunal in the U.K., which sided unanimously with hundreds of merchants who brought the case after a decade-long legal battle over these charges.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

- Make smarter investment decisions with TipRanks' Smart Investor Picks, delivered to your inbox every week.

The law firm Scott+Scott, which represents the claimants, called the ruling a major victory. David Scott, the firm’s global managing partner, said that the decision was “a significant win for all merchants who have been paying excessive interchange fees to Visa and Mastercard.” According to the firm, this is the first time a court has found that both commercial card fees and inter-regional (cross-border) multilateral interchange fees violate competition law. The ruling confirms that Visa and Mastercard’s fees unlawfully restricted competition by setting default rates that retailers had little choice but to accept.

Despite the setback, both Visa and Mastercard pushed back strongly against the ruling. A Visa spokesperson said that the company “continues to believe that interchange is a critical component to maintaining a secure digital payments ecosystem that benefits all parties, including consumers, merchants and banks.” Mastercard also criticized the decision by calling it “deeply flawed” and stating that it would seek permission to appeal. A second phase of the litigation is still underway, which will determine whether merchants passed on the cost of these interchange fees to consumers through higher prices. That upcoming trial could influence the amount of any potential damages.

Which Payment Stock Is the Better Buy?

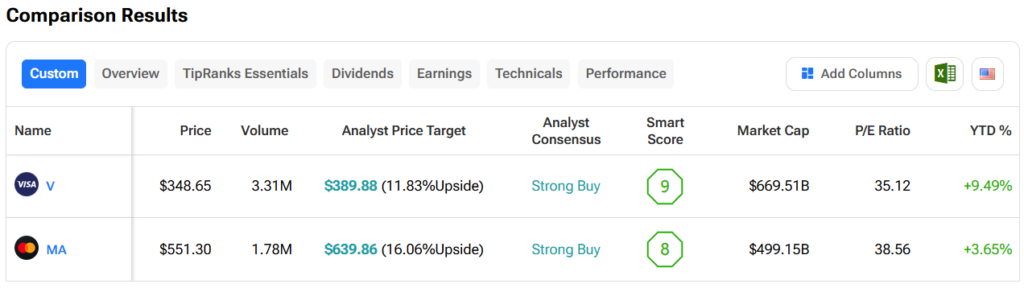

Turning to Wall Street, out of the two stocks mentioned above, analysts think that Mastercard stock has more room to run than Visa. In fact, Mastercard’s price target of $639.86 per share implies 16.1% upside versus Visa’s 11.8%.