Computer accessory company Logitech (LOGI) saw its stock drop on Wednesday as analysts ratings rolled in after its Fiscal Q4 2025 earnings report. As a quick refresher, LOGI posted adjusted earnings per share of 93 cents on revenue of $1.01 billion. These were mixed results next to Wall Street’s estimate of 88 cents per share and $1.01 billion in revenue.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

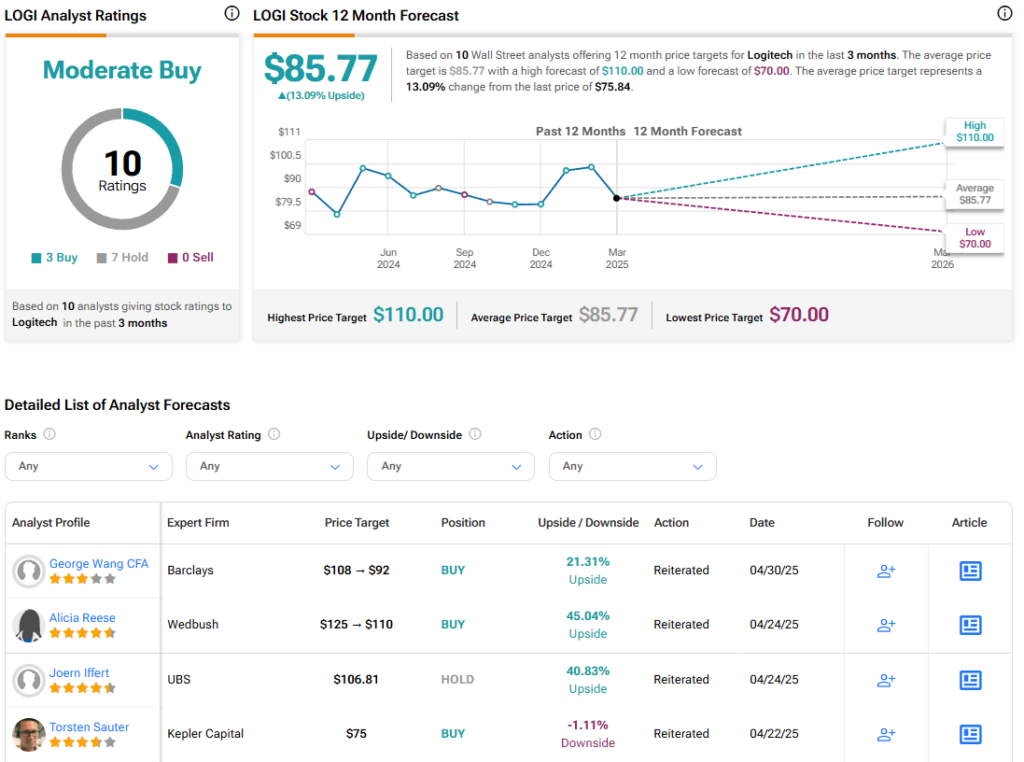

Barclays analyst George Wang reiterated a Buy rating for LOGI stock, but lowered his price target for the shares from $108 to $92. Even so, that still represents a potential 21.52% upside. He noted Q4 revenue fell short of expectations, but said that Q1 guidance was largely in-line with estimates, even with the looming threat of tariffs.

Looking ahead, Logitech expects Fiscal Q1 2026 revenue to range from $1.1 billion to $1.15 billion. That should see the mouse and keyboard company surpass analysts’ revenue estimate of $1.08 billion for the quarter.

LOGI Stock Movement Today

Logitech stock isn’t doing so hot after the company’s latest earnings report. The stock was down 3.2% as of this writing, building of the company’s 8.06% drop year-to-date. This is eating into its 52-week performance as well, with shares down 2.65% over the last year. Today’s stock movement came with heavy trading, as 1.13 million LOGI shares changed hands, compared to a three-month daily average of 923,600 units.

Is LOGI Stock a Buy, Sell, or Hold?

Turning to Wall Street, the analysts’ consensus rating for Logitech is Moderate Buy, based on three Buy and seven Hold ratings over the last three months. With that comes an average price target of $85.77, representing a potential 13.09% upside for LOGI stock. These ratings and price targets could change as more analysts update their coverage after earnings.