Defense major Lockheed Martin (LMT) continues to score major wins. Yesterday, LMT secured a $225 million contract from the Naval Air Systems Command. Additionally, LMT has bagged a $30 billion contract for about 375 F-35 fighter jets with a deal term of three years.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

This mega contract comes as the fighter jet’s price is anticipated to increase owing to inflation and slow production.

This ‘handshake deal’ is a step toward the final contract award. William LaPlante, the Chief Weapons Purchaser at the Pentagon, commented, “We are pleased to announce that the Department and Lockheed Martin have reached a handshake agreement for the next F-35 lot buy on a basis of 375 aircraft.”

The final quantity of aircraft could change depending on the 2023 Congress budget and any international orders. Notably, these wins underscore the resilience of the company’s offerings to consumer confidence and other macro-factors that have been impacting major names in the stock market this year.

All Eyes on Earnings

Furthermore, LMT’s second-quarter earnings webcast is scheduled for 11 a.m. EDT today, with numbers expected before the market opens. Analysts expect the company to post earnings of $1.88 per share. In the year-ago period, LMT had posted EPS of $6.52 versus the Street’s expectations of $6.53.

Analysts Are Cautious about LMT

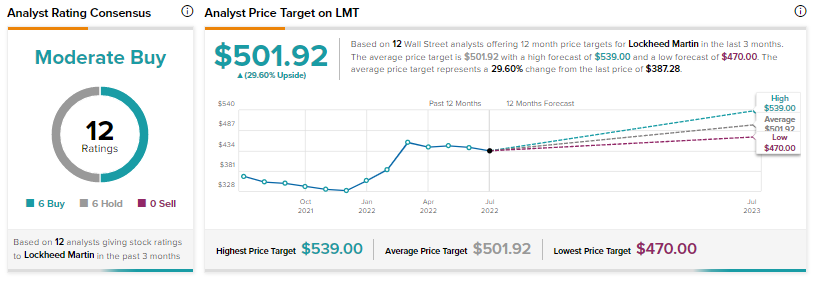

Ahead of the results, the Street is cautiously optimistic on LMT with a Moderate Buy consensus rating alongside an average price target of $501.92. This implies a 29.60% potential upside for the stock.

Closing Note

LMT has been a beneficiary of the positive investor sentiment toward defense names this year amid the Russia-Ukraine conflict. The company’s F-35 program continues to prove its supremacy, which remains a major positive for the stock.

Read full Disclosure