It will surprise no one who has set foot in a grocery store lately that grocery prices are still high. A new study from Loblaw (TSE:L), however, will likely provide little more in the way of news: those high prices will likely be the case for some time to come, and will actually grow faster than inflation. The news proved oddly welcome to investors, who sent shares up fractionally in Tuesday morning’s trading.

Loblaw rolled out a report about food cost inflation rates just ahead of a similar report from Statistics Canada, noted a report from The Canadian Press. That report would cover the Consumer Price Index figures for the month, and will likely offer little that most are not already familiar with. Loblaw looks for prices to not only continue to remain elevated, but also to continue past the pace of inflation.

As for reasons, they are almost as familiar as they are simple by now: the weaker Canadian dollar, rising production costs—workers need more money to actually buy the food they raise and package—and of course, those pesky supply chain issues are still all in play. Back in November, while overall inflation slipped to 1.9%, grocery prices gained 2.6%, a pattern that is likely to continue.

Looking for Younger Talent

Meanwhile, word from the Globe & Mail notes that Loblaw is looking for a few good men and women. More specifically, it is looking for a few younger good men and women. Loblaw is looking to its stores, and to college campuses, to help find the “next generation” of Loblaw employees all up and down the spectrum.

That is not just stockers and cashiers; the report noted how recent master of engineering graduate Manhar Joshi became a full-time Loblaw employee, bringing his engineering skill with him to the grocery chain. Joshi is not unique here, either, as Loblaw looks to do more of that kind of unconventional recruiting all throughout the organization.

Is Loblaw a Good Stock to Buy

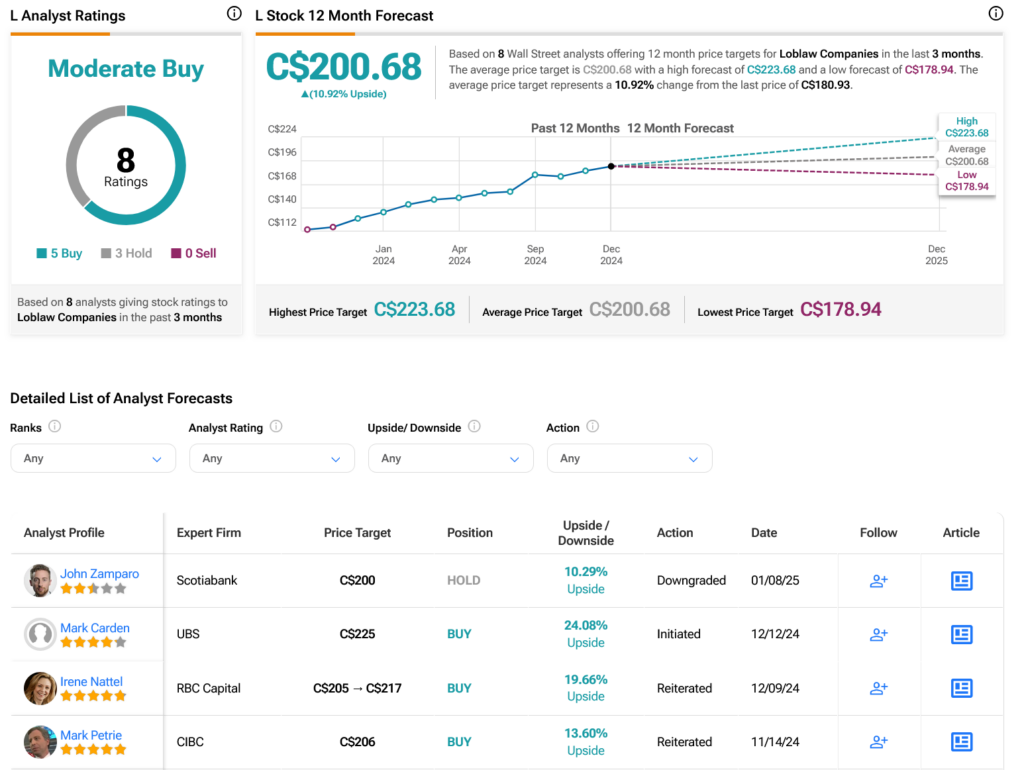

Turning to Wall Street, analysts have a Moderate Buy consensus rating on TSE:L stock based on five Buys and three Holds assigned in the past three months, as indicated by the graphic below. After a 37.64% rally in its share price over the past year, the average TSE:L price target of C$200.68 per share implies 10.92% upside potential.