Tesla (NASDAQ:TSLA) has not had an ideal year in 2024. Despite the broader bull market and a surge in tech stocks, the EV giant stands out as the only member of the Magnificent 7 to lose value this year.

Adding to the rough year, last week’s release of Tesla’s Q3 production and delivery numbers failed to offer much solace. While the 462,890 vehicles delivered aligned analyst forecasts, investors were clearly hoping for better news.

With Tesla’s ‘We, Robot’ event on the horizon tomorrow, investors are hoping for some exciting announcements that will swing momentum back in a positive direction.

Among the hopefuls is Oakoff Investments, an investor who, while anticipating the Robotaxi event, believes Tesla’s true potential lies in its ventures beyond the automotive realm.

“If we look at TSLA today as more than just an automotive stock, we can clearly see how its mobility and energy segments contribute to and explain its valuation premium,” writes the investor.

In the here and now, TSLA is primarily an EV maker, and Oakoff is confident that the company will “weather short-term demand and production difficulties to become a more efficient manufacturer.”

Looking ahead, Oakoff expects the Robotaxi event to showcase updates on Tesla’s autonomous vehicle efforts, potentially even demonstrating a prototype “cybercab” on a closed course.

“The potential impact and announcements during the event could, in my opinion, create a big bounce and make it clear to a greater number of investors that Tesla is not just about making cars today,” Oakoff opined.

It is this gaze towards the future that support the investor’s bullish views of Tesla’s long-term prospects. Oakoff adds that Tesla’s “strong cash flow and manageable debt” place the company in a healthy position to continue pouring resources into the R&D required to support future growth and expansion.

“If we assume that the company continues its business diversification and makes a smooth transition away from its dependence on its automotive business, then the stock appears undervalued based on various calculation methods,” Oakoff argues.

As such, Oakoff encourages investors to take advantage of the current dip ahead of the Robotaxi event, rating Tesla stock a Buy. (To watch Oakoff Investments’ track record, click here)

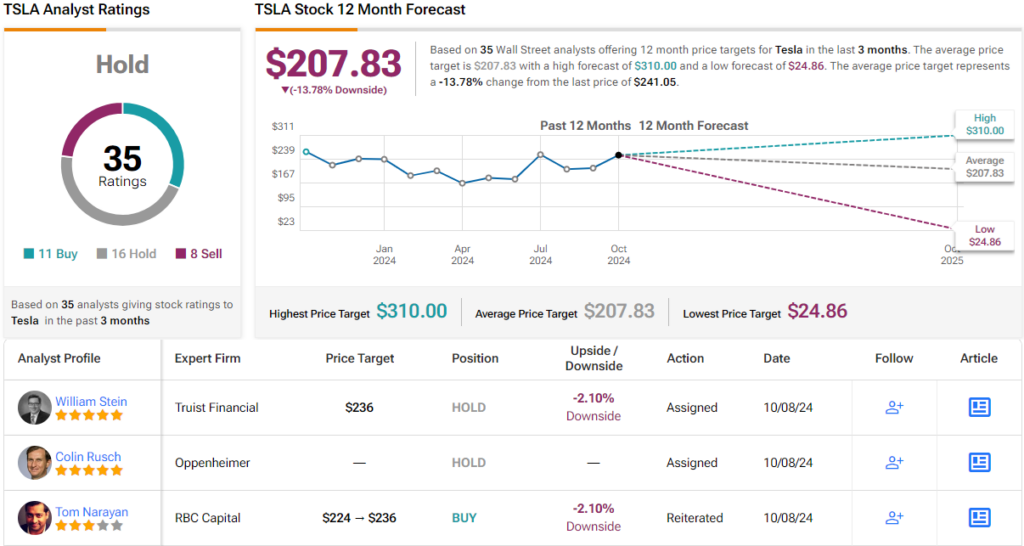

However, Wall Street sentiment is more tempered. With 11 Buys, 16 Holds, and 8 Sell ratings, Tesla holds a consensus rating of Hold. Its 12-month average price target of $210.83 suggests a potential downside of ~14%. (See TSLA stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.