UnitedHealth (NYSE:UNH) shares have lagged the broader markets by some distance in 2025, with the stock still deep into the red (down 30%). The year has been defined by disappointing quarterly results, with the company first cutting and then withdrawing its profit forecast. UNH then reinstated its outlook following the Q2 results, but it also fell short of Wall Street expectations, and soaring healthcare costs only reinforced bearish sentiment.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

But with the healthcare giant slated to release Q3 earnings later this month (October 28), Bernstein analyst Lance Wilkes thinks the readout will be a far more investor-pleasing event.

The analyst expects the company to deliver third-quarter results that meet or slightly exceed Street expectations of adj. EPS of $2.84 and a medical loss ratio of 90.7%. That said, Wilkes believes commentary around the 2026 guide will be of greater significance, noting that the company had previously indicated mid- to high-single-digit EPS growth for the year during the Q2 call. Wilkes thinks UNH may “modestly increase” that outlook either during the earnings call or in December.

Wilkes also sees a recovery for UnitedHealthcare between 2026 and 2028, led by improvements in its Medicare Advantage (MA) business. Margins are anticipated to fall by 48% in 2025, while revenue is expected to rise by 13%, reflecting MA mispricing and continued pressure across other segments. In 2026, the analyst anticipates that UHC’s pricing discipline in MA will reduce membership by about 8%, resulting in a 1% decrease in revenue. However, margins should recover by more than 50 basis points, leading to an expected 20% increase in UHC’s margins. The analyst also projects MA margins to expand by roughly 100 basis points in 2026, supporting a 20% improvement in UnitedHealthcare’s overall margin profile despite the smaller member base.

For Optum Health, Wilkes is calling for a recovery driven by “recontracting and exits.” Reflecting elevated medical loss ratios on value-based care capitation contracts and the absence of one-time benefits, earnings for 2025 are projected to fall by around 60%. For 2026, as Optum Health exits the MSO business, reprices contracts, and faces headwinds from a smaller UHC Medicare Advantage base, the analyst anticipates a 7% decline in revenue. However, margins are expected to improve by roughly 70 basis points. Wilkes thinks capitation margins will rise only modestly in 2026 but expects this recovery trend to continue through 2029.

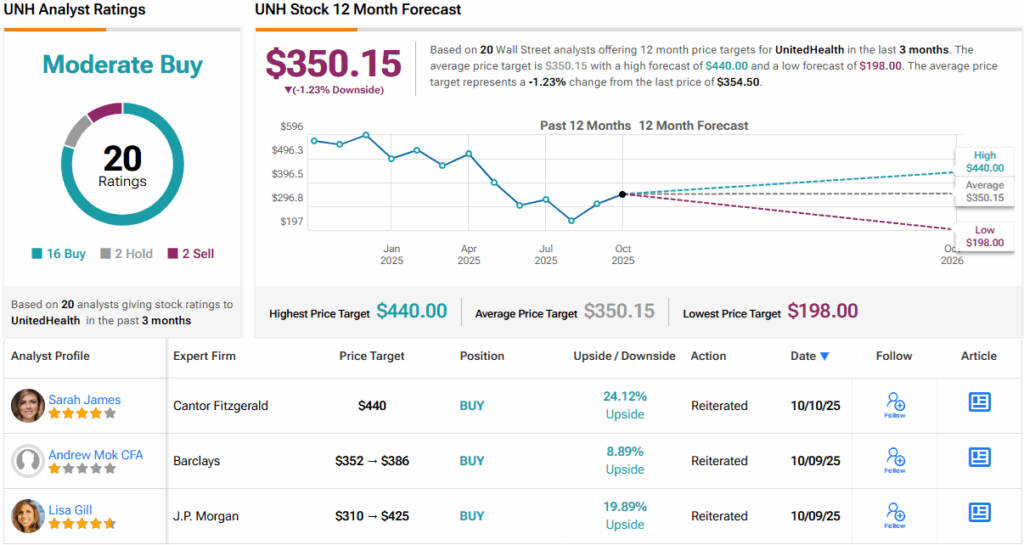

So, what does this all ultimately mean for investors? “We see UNH valuation as attractive given our expectation for outsized EPS growth recovery over the next 4 years,” said Wilkes, rating the shares as Outperform (i.e., Buy), and raising his price target from $379 to $433. Should the figure be met, investors will be pocketing returns of 22% a year from now. (To watch Wilkes’ track record, click here)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.