Tesla (NASDAQ:TSLA) stock had a roller-coaster 2025, skidding throughout much of the first half as CEO Elon Musk’s controversial government work took center stage against a backdrop of waning vehicle demand. However, this was followed by a surge to new highs toward the end of the year on prospects that the company’s AI, autonomous, and robotics plans were finally coming together.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

So, with 2026 now upon us, what comes next? For Baird analyst Ben Kalllo, attention turns to the “potential catalysts” ahead.

Among these is the wider robotaxi rollout, with Kallo expecting the year to feature several announcements regarding the service. These could include expansion into additional cities or geographies, the commencement of revenue recognition, and the securing of regulatory approvals to begin operations in China and the EU, among other potential milestones.

“We assume TSLA will begin operating robotaxi rides to customers as a paid service and generate material revenue in 2027,” the analyst expounded. “The fleet will be entirely TSLA-owned through 2028, with owners of TSLA vehicles able to contribute to the fleet in 2029 under our assumptions.”

Beyond the robotaxi, Kallo anticipates that 2026 will feature updates on Optimus production, along with additional clarity on the path and timing to commercialization. The analyst expects the first commercial Optimus sales to take place in late 2027, totaling approximately 5,000 units, while higher-volume production and the deployment of Optimus for in-house factory tasks are expected to go ahead in 2026. Kallo also sees the Tesla Semi launching at higher production volumes, alongside continued expansion in the Energy business.

As for other assumptions about what lies ahead, on the automotive front, the analyst has removed his prior Model 2 delivery expectations, as what Kallo had previously interpreted as a new vehicle form factor ultimately proved to be a new variant of the Model 3/Y platform. Additionally, Kallo’s current forecasts do not incorporate any capacity expansion beyond the existing installed capacity of approximately 3 million units per year.

On a separate note, Kallo points to several positive data points regarding FSD. TSLA’s FSD 14 was recently praised by Nvidia’s Robotics Director, Jim Fan, marking the latest in a series of favorable reviews highlighting the technology’s continued progress. “We expect this to gain more attention in 2026,” Kallo further added.

So, what does all this ultimately mean for investors? Kallo assigns an Outperform (i.e., Buy) rating on TSLA shares along with a price target of $548, suggesting the stock will gain 25% in the months ahead. (To watch Kallo’s track record, click here)

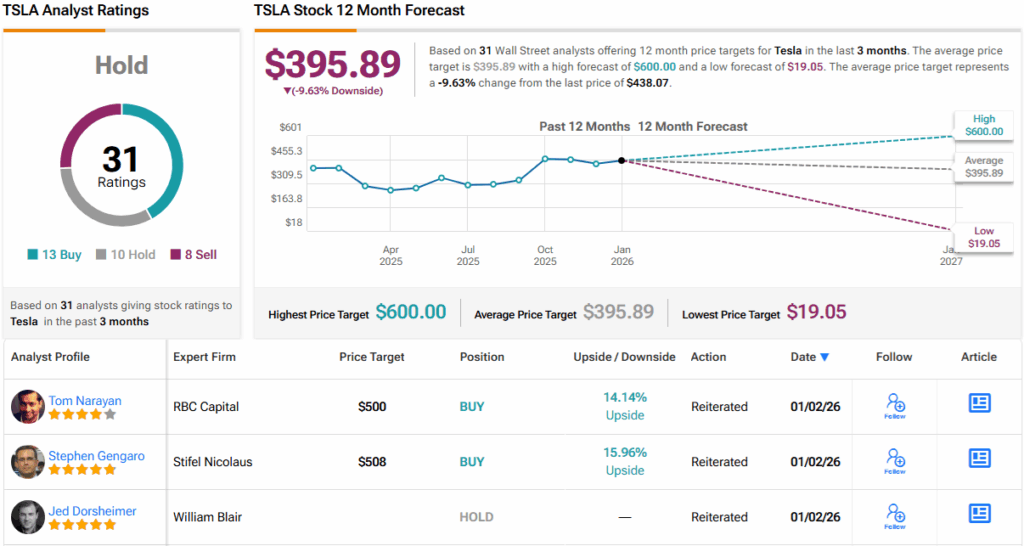

12 other analysts join Kallo in the TSLA bull camp, yet with an additional 10 Holds and 8 Sells, the stock only receives a Hold (i.e., Neutral) consensus rating. Most also think the shares are currently overvalued; at $395.89, the average target factors in a 12-month slide of ~10%. (See TSLA stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.