Stocks of leading U.S. defense contractors are down about 2% after President Donald Trump said he “will not permit” the companies to issue dividends or stock buybacks.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Shares of Lockheed Martin (LMT), General Dynamics (GD), and Northrop Grumman (NOC) are trending lower after Trump said the defense companies will not be able to reward their shareholders until they address his many complaints about the industry.

In a long social media post, Trump grumbled about executive pay packages at the defense contractors, calling it “exorbitant.” He also complained about how slowly U.S. defense contractors are delivering equipment to the U.S. military and its allies around the world.

Trump’s Impact on Shareholder Rewards

It is not clear if Trump has the authority or ability to prevent defense contractors from issuing shareholder rewards such as dividend payments. Currently, Lockheed Martin, General Dynamics, and Northrop Grumman offer dividend yields of between 1.5% and 2.70%.

The companies also buy back their own stock when market conditions are right. It’s not clear what prompted Trump’s social media post or why he has suddenly taken aim at the U.S. defense industry. His comments come days after the U.S. staged a military operation in Venezuela that led to the capture of President Nicolás Maduro.

Is LMT Stock a Buy?

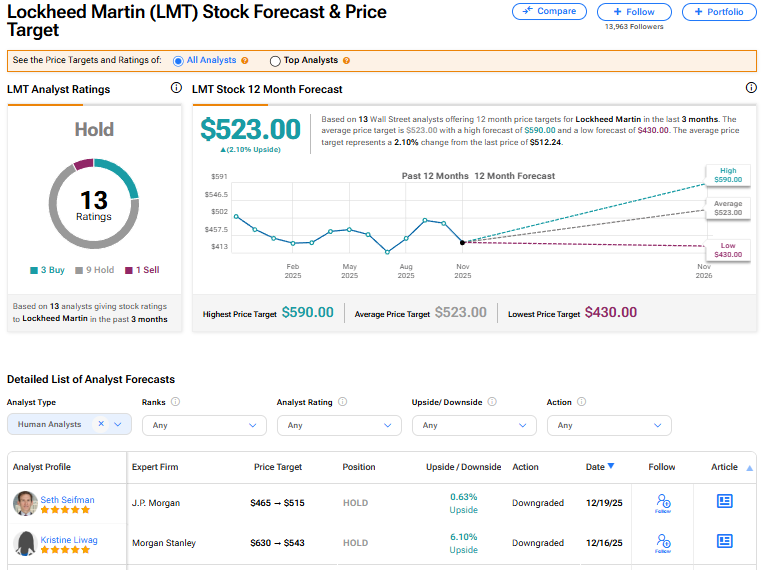

Lockheed Martin’s stock has a consensus Hold rating among 13 Wall Street analysts. That rating is based on three Buy, nine Hold, and one Sell recommendations issued in the last three months. The average LMT price target of $523 implies 2.10% upside from current levels.