Canada is planning to spend tens of billions more on its own defense in coming years, news that could mean a windfall for defense contractors in the U.S. and Europe.

With U.S. President Donald Trump threatening to annex Canada and make it the 51st state, the federal government is responding with increased military spending. Canadian Defense Minister Bill Blair recently said that Canada could spend an additional $10 billion to $13 billion per year on its defense.

Those billions of additional dollars could go towards new fighter jets and frigates, as well as upgrading the country’s missile defense, tanks, artillery and drones. It’s expected to add up to a windfall for defense contractors around the world.

Needed Supplies

Canada’s government has already committed $19 billion to acquire 88 F-35 fighter jets from U.S. defense contractor Lockheed Martin (LMT) and signed a $10 billion deal for P-8A Poseidon aircraft from Boeing Co. (BA). Canada also acquires its armored vehicles from U.S.-based General Dynamics (GD).

Officials in Ottawa, the Canadian capital, are also expected to spend more money on airbases, buildings, ports and military housing. Canada has also pledged to acquire a global military satellite communications system and beef-up its presence in the Arctic region.

New Canadian Prime Minister Mark Carney recently discussed closer military ties with his European counterparts on a trip to the continent. This has led to speculation that Canada may source more of its defense equipment from European contractors, such as the Saab ($SE:SAAB-B) Gripen fighter jet.

LMT stock has declined 10% so far in 2025.

Is LMT Stock a Buy?

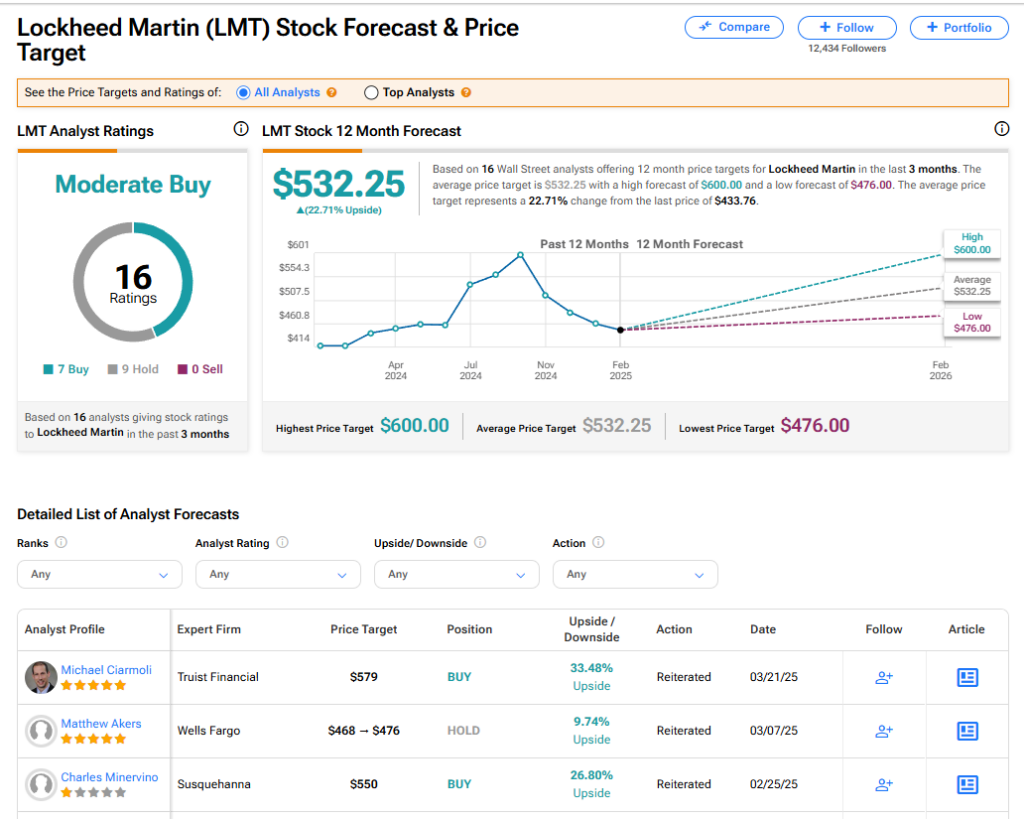

The stock of Lockheed Martin has a consensus Moderate Buy rating among 16 Wall Street analysts. That rating is based on seven Buy and nine Hold recommendations assigned in the last three months. The average LMT price target of $532.25 implies 22.71% upside from current levels.

Read more analyst ratings on LMT stock

Questions or Comments about the article? Write to editor@tipranks.com