Shares of Lockheed Martin (LMT) climbed after the company gave its FY24 forecast a boost. Now, the aerospace and defense heavyweight expects to pull in between $70.5 billion and $71.5 billion for the year, up from its earlier range of $68.5 billion to $70 billion. This positive adjustment comes on the back of a solid second quarter.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The company has projected FY24 earnings in the range of $26.10 to $26.60 per share, compared to its prior outlook between $25.65 and $26.35 per share. For reference, analysts were expecting $69.7 billion in revenue and earnings of $26.33 per share. This positive adjustment comes on the back of a solid second quarter.

LMT’s Q2 Results

Lockheed Martin reported impressive numbers for the second quarter, with adjusted earnings per share hitting $6.85—beating analysts’ estimate of $6.46. Total sales jumped 8.5% year-over-year to $18.12 billion, surpassing the $17.04 billion expected. A big factor in this boost was the resumption of F-35 deliveries, which had been paused for a few months due to delays with a key software upgrade.

Jim Taiclet, Lockheed Martin’s CEO, emphasized the importance of the F-35 program, which makes up about 30% of the company’s revenue. “The F-35 remains a top priority,” Taiclet said, adding that they’ve started delivering the upgraded TR-3 versions of the aircraft. They’re expecting to deliver between 75 and 110 F-35s in 2024.

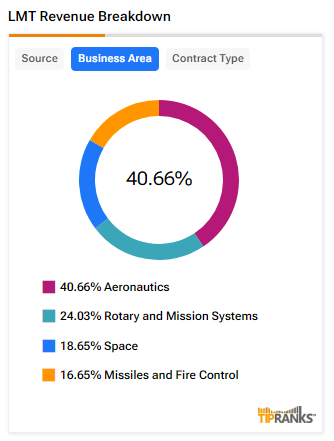

LMT’s Revenue Breakdown

The aeronautics segment, which includes the F-35 and F-16 programs, was a major revenue driver, making up more than 40% of total sales. It brought in $7.3 billion in the second quarter, a 6% increase from last year. This rise came from $335 million in higher sales of the F-35 and $105 million from ramped-up F-16 production.

Some analysts have noted that the revenue beat might partly be due to timing issues, suggesting that the boost might not last. Despite this, Lockheed Martin’s stronger forecast and solid Q2 results show a defense sector that’s staying strong and adapting to new needs.

Is LMT Stock a Good Buy?

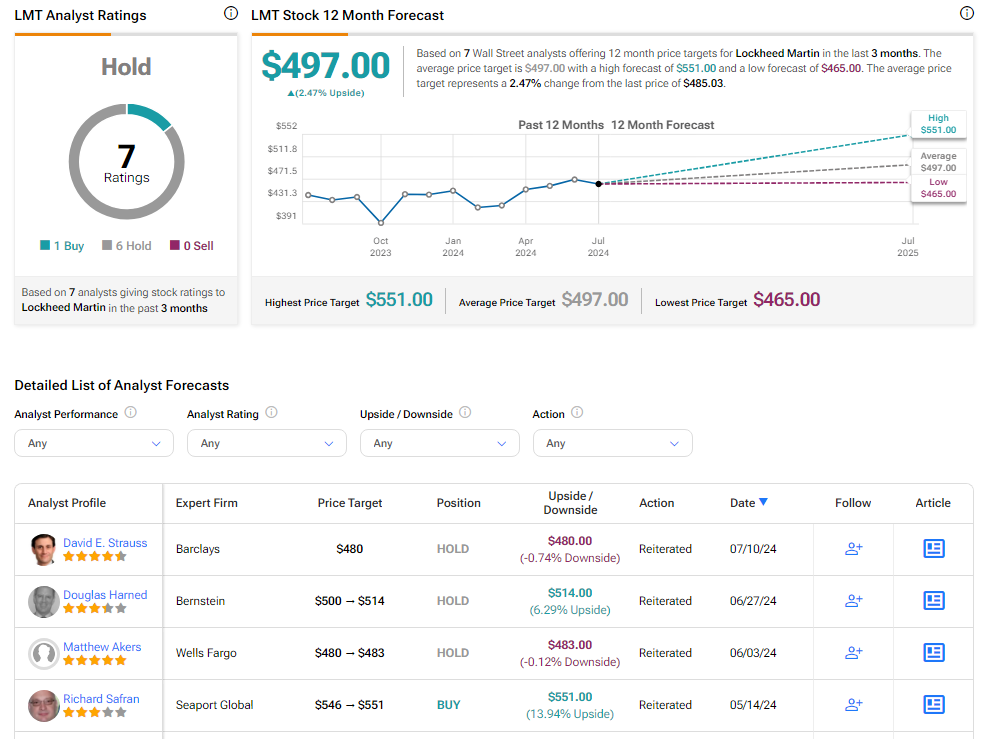

Analysts remain sidelined about LMT stock, with a Hold consensus rating based on one Buy and six Holds. Over the past year, LMT has increased by more than 8%, and the average LMT price target of $497 implies an upside potential of 2.5% from current levels. These analyst ratings are likely to change following LMT’s Q2 results today.