Lemonade (NYSE:LMND) plummeted in pre-market trading after providing a disappointing Q1 outlook. The insurance company expects Q1 revenues of $111 million to $113 million, below consensus estimates of $119.5 million. The company’s adjusted EBITDA loss is forecasted to improve by 19% year-over-year to a range of -$43 million to -$41 million in the first quarter. Additionally, Lemonade has projected in-force premiums (premiums paid for an active insurance policy) of $789 million to $791 million, a growth of 21% year-over-year.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

In FY24, Lemonade expects revenues between $505 million and $510 million, below Street estimates of $520.9 million, while adjusted EBITDA loss is likely to be in the range of -$160 million to -$155 million.

In the fourth quarter, LMND generated revenues of $115.5 million, an increase of 31% year-over-year and above consensus estimates of $111.7 million. The company’s Q4 loss narrowed to -$0.61 per share as compared to -$0.93 per share in the same period last year, an improvement over analysts’ estimates of -$0.80 per share.

What Is the Future of LMND Stock?

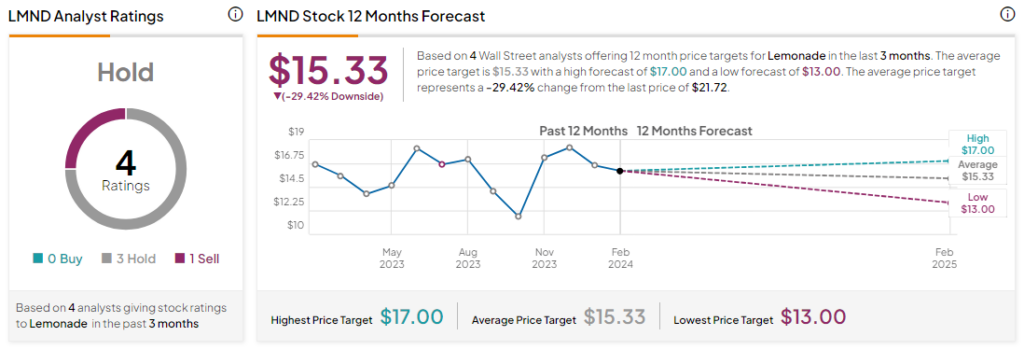

Analysts remained sidelined about LMND stock with a Hold consensus rating based on three Holds and one Sell. Over the past year, LMND stock has dropped by more than 30%, and the average LMND price target of $15.33 implies a downside potential of 29.4% at current levels. However, it’s worth noting that estimates will likely change following today’s earnings report.