In this piece, I evaluated two big pharma stocks, Eli Lilly (NYSE:LLY) and Johnson & Johnson (NYSE:JNJ), using TipRanks’ Comparison Tool below. A closer look suggests a neutral view for Eli Lilly and a bullish view for Johnson & Johnson.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Eli Lilly is a leading healthcare company that manufactures and sells pharmaceutical products, while Johnson & Johnson provides consumer and pharmaceutical products and medical devices. Shares of Eli Lilly have surged 26% year-to-date and are up 92% over the last 12 months, while Johnson & Johnson stock is off 4% year-to-date and down 6% over the last year.

With such a dramatic difference in share-price performance, it’s no surprise that Eli Lilly’s valuation is far higher than Johnson & Johnson’s. Below, we’ll compare their price-to-earnings (P/E) ratios to gauge their valuations against each other and against that of their industry.

Bridging the massive gap in the two companies’ valuations, the pharmaceutical industry is trading at a P/E of 59.9 versus its three-year average of 41.

Eli Lilly (NYSE:LLY)

At a P/E of 126, Eli Lilly is trading at a much higher valuation than Johnson & Johnson, likely due to the hype surrounding a new class of diabetes drugs that’s being expanded to other conditions like obesity. Amid all that hype, Eli Lilly is simply too expensive right now, especially compared to its five-year mean P/E of 48.3, although it’s not a bad company. Thus, a neutral view seems appropriate, pending a significant sell-off that results in a more reasonable valuation.

GLP-1 drugs have been all the rage on Wall Street, especially as their use has expanded to include obesity and other conditions. In fact, Eli Lilly announced promising results last week for its weight-loss drug tirzepatide in treating obstructive sleep apnea. Unsurprisingly, its stock price didn’t really climb after the announcement because it’s already quite richly valued.

However, there is a catalyst coming for Eli Lilly next week that could trigger a slide in its stock price if there’s even a hint of disappointment. The company is slated to report its first-quarter earnings results on April 30, and analysts are looking for earnings of $2.47 per share on $8.9 billion in revenue. In the year-ago quarter, Eli Lilly posted earnings of $1.62 per share on $7 billion in sales.

The company’s sales number will be critical, given the Food and Drug Administration’s recent report that Eli Lilly’s Zepbound and Mounjaro (both brand names for tirzepatide) will be in short supply through the second quarter due to soaring demand.

Importantly, tirzepatide played a key role in the company’s sizable fourth-quarter earnings beat. Eli Lilly also said about a month ago that two of its insulin products would be out of stock through early April, further crimping its first-quarter sales.

As a result, investors should be wary of a potential drawdown stemming from a possible revenue miss going into the first-quarter earnings release. However, any significant sell-off would likely present a buying opportunity in Eli Lilly stock, which would be good news, given its long-term share-price gains of 305% over the last three years, 569% over the last five, and 1,429% over the last 10.

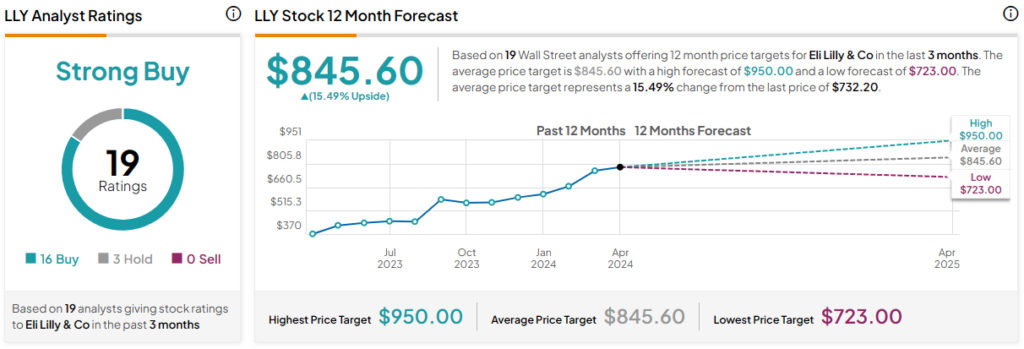

What Is the Price Target for LLY Stock?

Eli Lilly has a Strong Buy consensus rating based on 16 Buys, three Holds, and zero Sell ratings assigned over the last three months. At $845.60, the average Eli Lilly stock price target implies upside potential of 15.5%.

Johnson & Johnson (NYSE:JNJ)

At a P/E of 19.5, Johnson & Johnson is trading at a steep discount to the pharmaceutical market and to its five-year mean P/E of 25.85. While it does deserve a lower valuation than Eli Lilly due to the mix of consumer products it sells alongside its pharmaceutical products, Johnson & Johnson simply looks undervalued, making a bullish view seem appropriate.

The stock has been climbing steadily higher since the company’s latest win in yet another lawsuit related to its talc-based baby powder. The jury in the case ruled that Patricia Matthey’s cancer was not caused by her use of talcum powder — the same outcome reached in 16 of the 17 ovarian cancer cases that have been tried so far.

The fallout over talcum power has been plaguing JNJ and other manufacturers for years — since cancer-causing asbestos was found in at least one talc product. However, the recent case found that Johnson & Johnson’s talcum powder didn’t contain any asbestos.

Nonetheless, the company has had its share of talc-related losses and settlements as well, which have remained an overhang on its stock. For example, 22 women with ovarian cancer received a $2.1 billion judgment in 2021. On the other hand, an appeals court in New Jersey threw out a $223.7 million ruling against Johnson & Johnson last year after deciding that the testimony of the plaintiffs’ expert witnesses was unsound.

The latest in the case is that the company will have a chance to contest evidence linking its talc to cancer, which could eventually be a major win. Unfortunately, this looks like one overhang that won’t be gone anytime soon, but even with this overhang, JNJ stock hasn’t been this cheap on a trailing P/E basis in more than five years. In fact, HSBC (NYSE:HSBC) upgraded Johnson & Johnson to Buy recently, noting that the stock had reached three-year lows.

Thus, JNJ just looks too cheap to ignore, although investors should keep in mind that it remains a high-risk stock. However, JNJ’s attractive dividend yield of 3.3% offers a sort of consolation prize while awaiting a return to the five-year mean P/E — or at least something closer to it than where it is now.

Finally, the steady increases in dividend payments for more than 60 years demonstrate that Johnson & Johnson’s dividend isn’t going anywhere anytime soon.

What Is the Price Target for JNJ Stock?

Johnson & Johnson has a Moderate Buy consensus rating based on six Buys, six Holds, and zero Sell ratings assigned over the last three months. At $179.17, the average Johnson & Johnson stock price target implies upside potential of 20.6%.

Conclusion: Neutral on LLY, Bullish on JNJ

Both Eli Lilly and Johnson & Johnson are attractive companies with solid track records. However, Eli Lilly’s valuation has just gotten too high, while Johnson & Johnson looks too cheap to ignore, even with the talc overhang. Both stocks are worth watching — Eli Lilly for a more reasonable entry point (although it might take a while to reach one) and Johnson & Johnson for more news related to the thousands of talc-related lawsuits. However, valuations give JNJ the win over LLY, at least for now.