Eli Lilly (NYSE:LLY) gained in pre-market trading after the company reported its Q1 results. The pharmaceutical company’s adjusted earnings per share came in at $2.58, marking a 59% increase year-over-year, surpassing analysts’ consensus estimate of $2.47 per share.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The company posted revenues of $8.76 billion in the first quarter, an increase of 26% year-over-year, but fell short of analysts’ expectations of $8.9 billion. The growth in revenues was primarily driven by a 16% increase in volume and a 10% rise from higher realized prices. The rise in volumes was mainly driven by growth in drugs like Mounjaro, Zepbound, Verzenio, and Jardiance.

Importantly, Eli Lilly’s weight loss drug Zepbound saw sales of $517.4 million in the first quarter.

LLY’s FY24 Guidance

Looking forward, in FY24 expects its revenues to be in the range of $42.4 billion to $43.6 billion, an increase of $2 billion at both the upper and lower end of the range. Adjusted earnings are projected to be between $13.50 and $14.00 per share in FY24, up from its prior guidance in the range of $12.20 to $12.70 per share.

Is LLY Stock a Buy?

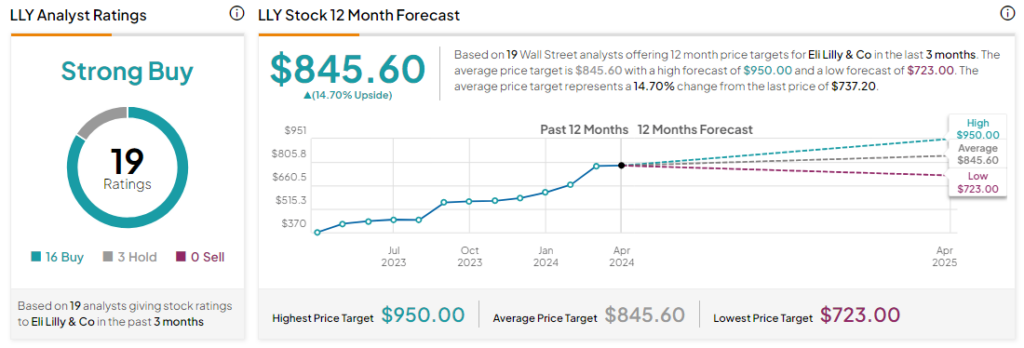

Analysts remain bullish about LLY stock, with a Strong Buy consensus rating based on 16 Buys and three Holds. Year-to-date, LLY has increased by more than 25%, and the average LLY price target of $845.60 implies an upside potential of 14.7% from current levels. These analyst ratings are likely to change following LLY’s Q1 results today.