FTSE 100-listed Barratt Developments PLC (GB:DBEV) and Lloyds Banking Group PLC (GB:LLOY) have joined forces with the UK government’s housing agency, Homes England, for a major expansion of housing projects across the county. This partnership will allow these companies to leverage the Labour Party’s initiative to revive the housing sector and build 1.5 million new homes across the UK, which is the largest commitment seen in nearly 50 years.

Barratt Developments is a house-builder focused on residential property development, while Lloyds is the UK’s oldest bank known for its expertise in mortgage lending. Following the news, LLOY stock gained 1.6% as of writing. Meanwhile, Barratt shares were up by almost 1%.

Barratt and Lloyds Collaborate with Homes England

The deal will be executed through a joint venture named MADE Partnership. Barratt, Lloyds, and Homes England will contribute £50 million each in initial funding to kickstart the MADE Partnership and will hold equal stakes.

This partnership will manage a series of expansive projects such as town expansions, new garden village-style communities, and brownfield site developments, with each project ranging from 1,000 to 100,000 homes.

Last week, Barratt reported its FY24 results, highlighting some positive signs in the UK housing market, driven by the new Labour government’s improved focus on this sector. Barratt further stated that it seeks to capitalize on the potential recovery of the UK’s housing market and bolster its position as a leading homebuilder.

Interestingly, RBC analyst Anthony Codling highlighted the challenges that come along with this partnership. He noted that the venture will deliver its first set of completed homes in or after 2028-29. This showcases the challenges in finding and preparing large sites for development.

Are Lloyds Shares a Good Buy Now?

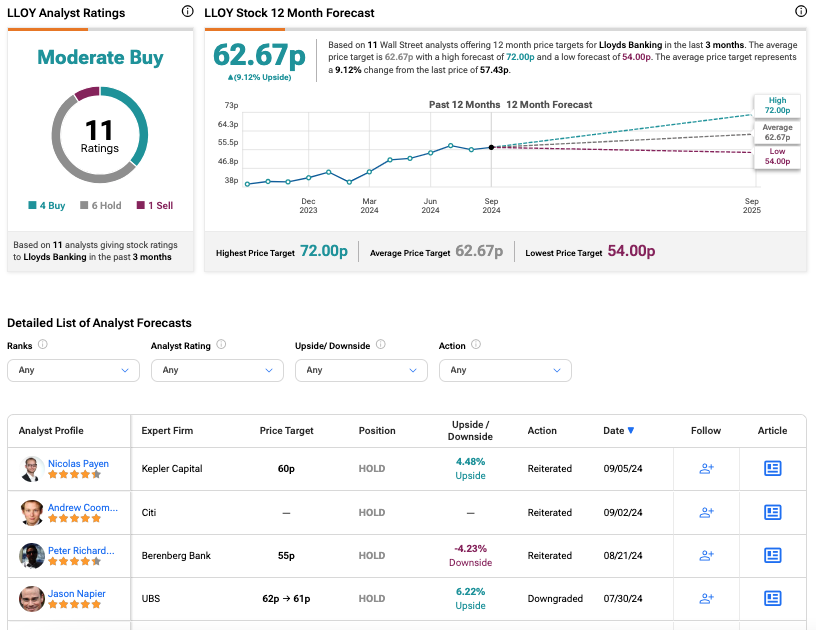

According to TipRanks’ analyst consensus, LLOY stock has a Moderate Buy rating based on 11 recommendations, of which four are Buys. The Lloyds share price target is 62.67p, which reflects about 9.12% upside potential in the share price.