The Department of Justice (DOJ) has intensified its investigation against Live Nation Entertainment (NYSE:LYV) for anticompetitive deals involving artists and event venues. As per a Wall Street Journal report, the DOJ is examining Live Nation’s contracts to determine whether they contain any clauses restricting artists from working with other agencies and stopping venues from working with other promoters. LYV stock fell 1.7% in extended trade yesterday following the news.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Competitors are alleging that Live Nation and its ticketing unit, Ticket Master, can pay more to artists as it has a monopoly across all of the functions of promotion, ticketing, artists, and venues. Meanwhile, Live Nation is contending that it pays artists and venues more because it follows a “competitive bidding” process. The DOJ has been investigating Live Nation since last year, and the probe became stronger following the Taylor Swift ticketing fiasco.

The news of the DOJ’s enhanced probe comes as Live Nation prepares to report its third quarter Fiscal 2023 results today, after the bell. The Street expects LYV to post diluted earnings of $1.26 per share on revenues of $6.99 billion. In Q3FY22, Live Nation posted diluted earnings of $1.39 per share on revenues of $6.15 billion.

What is the Target Price for LYV?

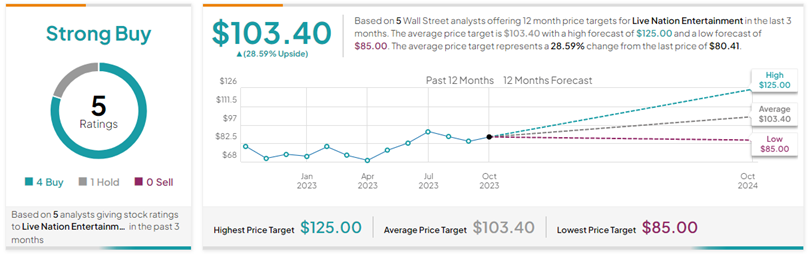

Ahead of its Q3 print, Roth MKM analyst Eric Handler cut the price target on LYV stock to $85 from $102 and maintained a Hold rating. Although Handler expects a robust quarterly performance from the company, he is unsure about the consumer spending pattern.

With four Buys and one Hold rating, LYV commands a Strong Buy consensus rating on TipRanks. The average Live Nation Entertainment price target of $103.40 implies 28.6% upside potential from current levels. Meanwhile, LYV stock has gained 16.8% so far this year.