Investors in Lucid Group (NASDAQ:LCID) were likely happy to leave 2025 in their rearview mirror. The company’s share price dripped lower and lower throughout the past year, chalking up losses of more than 65%.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

While the market wasn’t thrilled by continued revenue losses and a reduced production outlook, the EV company has succeeded in ramping up production of late.

Q3 marked Lucid’s seventh consecutive quarter of increased production, and its 4,078 vehicle deliveries were up 47% year-over-year. While the company continues to operate in the red, Lucid took additional steps to shore up its liquidity by increasing its loan credit facility with the deep-pocketed Saudi Arabian Public Investment Fund from $750 million to some $2 billion. The company also raised some $975 million in convertible senior notes.

Could 2026 usher in a new era of growth and value for shareholders? Investor Daniel Miller isn’t so certain.

“Lucid promotes its consistent and continuous record of quarterly deliveries, but it’s essential to recognize that Lucid faces numerous challenges ahead to achieve scale in production and deliveries, while also reducing costs to drive profitability,” explains the 5-star investor.

That’s not to say that Miller doesn’t recognize progress. He notes both the recent quarterly delivery record in Q3 as well as the potential for a lower-priced Gravity SUV to dramatically expand sales.

“The Gravity is expected to have six times the addressable market as Lucid’s Air sedan, leaving immense potential in the near term as production ramps up,” emphasizes Miller.

However, the investor has a hard time looking beyond Lucid’s production issues, which forced the company to lower its full-year delivery guidance as the year progressed. Moreover, Miller is worried about the possibility of continued capital raises.

“For most investors, Lucid is currently too risky to invest in, even with likely more record quarters ahead,” concludes Miller. (To watch Daniel Miller’s track record, click here)

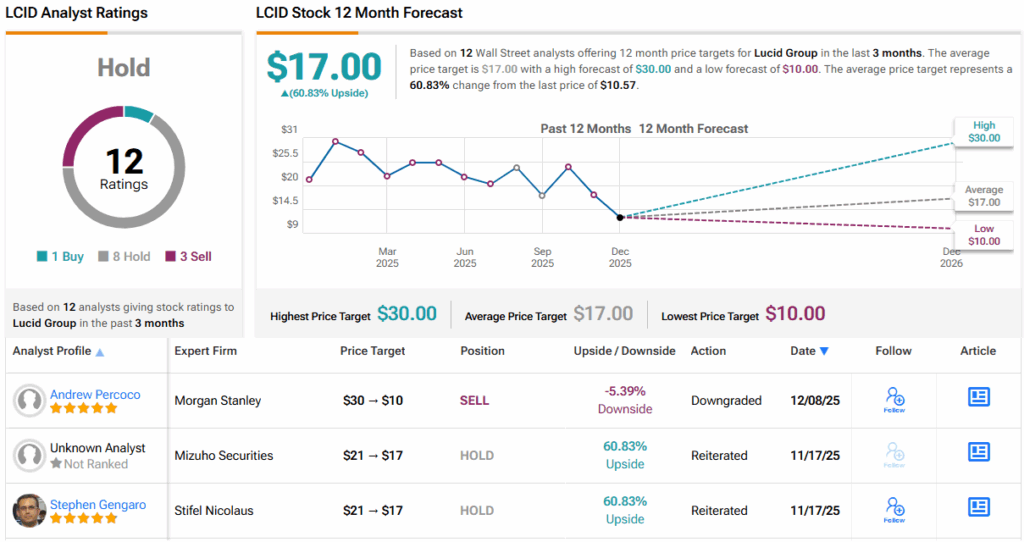

Wall Street is sitting tight for the time being. With 8 Holds far outweighing 1 Buy and 3 Sells, LCID carries a consensus Hold (i.e., Neutral) rating. Its 12-month average price target of $17.00 does reflect significant optimism, however, as it would translate into gains of over 60% in 2026. (See LCID stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.